Introduction

Investing in the stock market can be a thrilling venture, but it also comes with its share of risks. One of the biggest threats to investors is the array of sneaky stock market scams that can lead to significant financial loss. Understanding these scams is crucial to protecting your investments and ensuring a safe trading environment.

The importance of understanding stock market scams

Stock-market scams have become more sophisticated over the years. As technology advances, so do the methods used by fraudsters to deceive unsuspecting investors. By being aware of these schemes, you can safeguard your investments and make informed decisions.

The rise of fraudulent schemes

With the increased accessibility of stock trading platforms and the growth of online communities, fraudulent schemes have also risen. Scammers exploit the lack of regulation and the anonymity of the internet to carry out their schemes, making it essential for investors to stay informed.

Must Read: Investing Made Easy: Top Stock Market Apps for Beginners in 2024

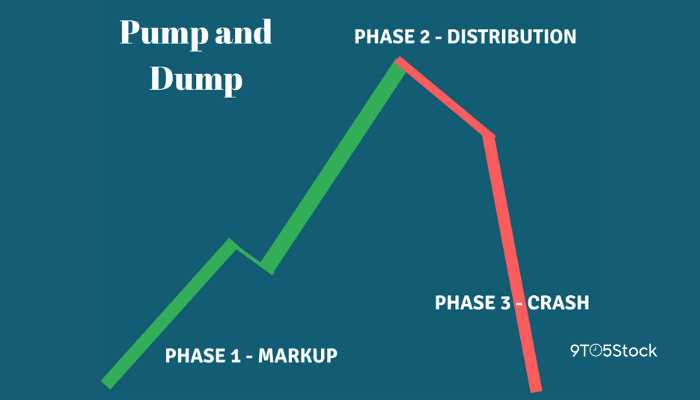

1. Pump and Dump Schemes

What is a pump and dump?

A pump-and-dump scheme involves artificially inflating the price of a stock through false or misleading statements. Scammers “pump” up the stock price by spreading rumors or false information, then “dump” their shares at the inflated price, leaving other investors with worthless stock.

Famous examples of pump and dumps

One of the most notorious cases was the Wolf of Wall Street scandal, where brokers manipulated penny stocks and made millions at the expense of unsuspecting investors. These schemes can result in massive financial losses for those who buy into the hype.

2. Insider Trading

How insider trading works

Insider trading occurs when someone with non-public, material information about a company uses that information to make profitable trades. This illegal activity undermines the integrity of the stock market and creates an uneven playing field for regular investors.

legal consequences of insider trading

Those caught engaging in insider trading face severe penalties, including hefty fines and imprisonment. High-profile cases, like that of Martha Stewart, highlight the serious repercussions of insider trading.

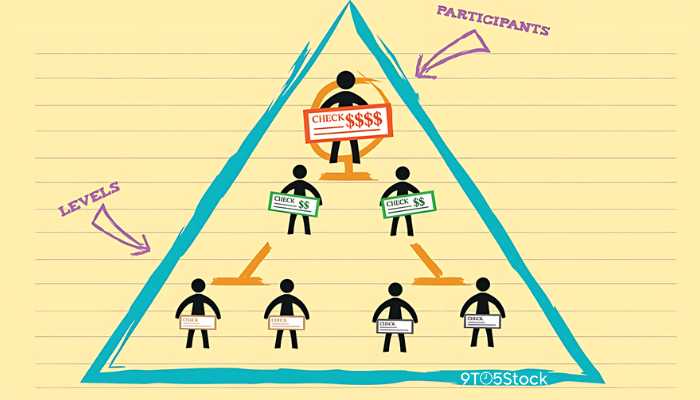

3. Ponzi Schemes

Understanding Ponzi schemes

A Ponzi scheme is a fraudulent investment scam promising high returns with little risk. Early investors are paid returns with the capital from newer investors, creating a cycle that eventually collapses when new investments dry up.

Notorious Ponzi schemes in history

Bernie Madoff’s Ponzi scheme is perhaps the most infamous, with losses estimated at $65 billion. These schemes prey on investor greed and trust, leading to devastating financial consequences.

4. Fake News and Rumors

Impact of fake news on stocks

Fake news and rumors can significantly impact stock prices, often leading to rapid price movements. Scammers spread false information to manipulate stock prices, taking advantage of the ensuing market volatility.

How to identify fake news

To avoid falling for fake news, always verify the information from multiple credible sources. Look for news from established financial news outlets and be wary of sensationalist headlines.

5. Boiler Room Scams

The tactics used in boiler room scams

Boiler room scams involve high-pressure sales tactics by unlicensed brokers who cold-call investors. These scammers use aggressive marketing techniques to sell worthless or non-existent stocks, often targeting vulnerable individuals.

How to recognize a boiler room operation

If you receive unsolicited calls pushing you to invest in a “can’t miss” opportunity, it’s likely a boiler room scam. Always verify the credentials of the person and the legitimacy of the investment before committing any funds.

6. Binary Options Fraud

The allure of binary options

Binary options are a type of financial instrument that offers a fixed return based on a yes-or-no proposition. They appeal to investors due to their simplicity and the promise of quick returns.

Red flags of binary options scams

Many binary options platforms are fraudulent, manipulating the outcome to ensure investors lose money. Be cautious of platforms that are unregulated and have unclear terms and conditions.

7. Protecting Yourself from Scams

Conduct thorough research

Before investing in any stock or financial product, do your due diligence. Research the company, its financials, and its market position. Avoid investments that seem too good to be true.

Trustworthy sources of information

Rely on information from reputable financial news sources, official company filings, and regulatory body announcements. Steer clear of tips from anonymous online forums or social media.

8. The Role of Regulatory Bodies

SEC and its functions

The Securities and Exchange Commission (SEC) plays a crucial role in protecting investors and maintaining fair markets. They enforce securities laws and regulate the stock market to prevent fraud.

Other global regulatory organizations

Other regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK and the European Securities and Markets Authority (ESMA), also work to safeguard investors. These organizations provide oversight and enforce regulations to curb fraudulent activities.

9. How Technology is Fighting Scams

AI and machine learning in scam detection

Advancements in AI and machine learning are helping to detect and prevent stock market scams. These technologies analyze trading patterns and identify suspicious activities, allowing for quicker intervention.

Blockchain for transparency

Blockchain technology offers greater transparency and security in financial transactions. By recording transactions on an immutable ledger, blockchain can help prevent fraudulent activities and ensure the integrity of the stock market.

10. Real-Life Stories from Victims

Lessons learned from victims

Hearing from those who have fallen victim to stock market scams can provide valuable lessons. Many victims emphasize the importance of skepticism and thorough research before making any investment.

How they recovered

Recovery can be challenging, but with legal help and support, many victims manage to regain some of their losses. Staying informed and vigilant is key to avoiding future scams.

11. The Psychological Manipulation in Scams

Understanding the psychological tactics

Scammers often use psychological manipulation to exploit investors’ emotions. They play on fear, greed, and urgency to push individuals into making hasty decisions.

How to stay vigilant

Being aware of these tactics can help you stay cautious. Always take the time to think through your investment decisions and avoid making choices based on emotion.

12. Legal Actions and Recourses

What to do if you’re a victim

If you fall victim to a stock market scam, report it to the relevant authorities immediately. Gather all the evidence and seek legal advice to explore your options for recourse.

Legal pathways and support

There are legal avenues to pursue compensation, such as class-action lawsuits and arbitration. Consulting with a financial fraud attorney can provide guidance on the best course of action.

13. Educating New Investors

Resources for learning about the stock market

Educating yourself about the stock market is the best defense against scams. Utilize resources like books, online courses, and financial news outlets to build your knowledge.

The importance of financial literacy

Financial literacy is crucial for making informed investment decisions. Understanding basic financial concepts can help you recognize red flags and avoid fraudulent schemes.

Conclusion

Summarizing key points

Stock market scams are a significant threat to investors, but by understanding the various types of scams and how to avoid them, you can protect your investments. Always conduct thorough research, rely on trustworthy sources, and remain vigilant against psychological manipulation.

Encouraging proactive vigilance

Stay informed about the latest scams and maintain a healthy skepticism towards too-good-to-be-true investment opportunities. By being proactive, you can dodge the traps set by scammers and safeguard your financial future.

May You Like

- Top ASX Shares for Long-Term Growth (2024)

- Exploring Different Trading Strategies: Swing, Scalping, and More

- How to Boost Your Savings with Smart Stock Strategies! (2024)

- Top 10 Penny Stocks to Watch: Your Ultimate Guide to Big Gains in 2024

- How to Diversify Your Portfolio with ASX Shares

FAQs

How can I spot a scam?

Look for red flags such as high-pressure sales tactics, promises of guaranteed returns, and lack of transparency about the investment.

What should I do if I suspect a scam?

Report it to the relevant regulatory bodies and seek legal advice. Avoid investing any more money and gather evidence to support your case.

Are all high-return investments scams?

Not necessarily, but high-return investments come with high risks. Always do your research and understand the risks involved before investing.

How do regulatory bodies help?

Regulatory bodies enforce securities laws, regulate the stock market, and provide oversight to prevent and address fraudulent activities.

Can technology completely eliminate scams?

While technology can significantly reduce the incidence of scams, it cannot completely eliminate them. Staying informed and vigilant is essential.

Disclaimer: The information provided in this article is for educational and informational purposes only. It is not intended to be, nor does it constitute, financial, investment, or legal advice. Investing in the stock market involves risk, and it is important to conduct your own research and seek advice from qualified professionals before making any investment decisions. The author and publisher are not responsible for any financial losses or damages incurred as a result of following the advice or information provided in this article. Always be vigilant and use caution when considering investments to protect your financial interests.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!