As the U.S. presidential election draws near, cryptocurrency markets are seeing significant inflows, with traders preparing for potential price swings. Investors are closely watching the election’s impact on crypto-friendly policies, particularly as former President Donald Trump, a known crypto supporter, competes against Democrat Kamala Harris. Amid this uncertainty, major exchange-traded funds (ETFs) tracking Bitcoin have attracted substantial investments, signaling strong interest in the sector and heightened expectations of volatility.

BlackRock’s iShares Bitcoin Trust Sees Record Inflows

BlackRock’s iShares Bitcoin Trust ETF, the largest Bitcoin-focused ETF in the market, witnessed an extraordinary influx, pulling in $872 million in a single day. This remarkable flow is the fund’s largest since its debut in January, showing that investors are betting heavily on Bitcoin in anticipation of the election’s outcome. In total, Bitcoin-tracking ETFs saw inflows of $917.2 million on a recent Wednesday, marking the highest single-day increase since March, as reported by The Block, a crypto data provider.

Bitcoin’s Price Surges as Election-Related Speculation Grows

Bitcoin surged by around 12% in October, driven by speculation that Trump’s potential re-election could positively impact the crypto market. Trump has presented himself as a pro-crypto candidate, which has contributed to optimism about the future of cryptocurrency regulations if he were to secure a second term. According to analysts at Ryze Labs, the possibility of a Republican-led administration has fueled investor confidence in crypto-friendly legislation post-election.

Also Read: October Passenger Vehicle (PV) Market Overview: Sales Remain Steady, Retail Growth Surges by 34% YoY

Tight Presidential Race Adds to Market Anticipation

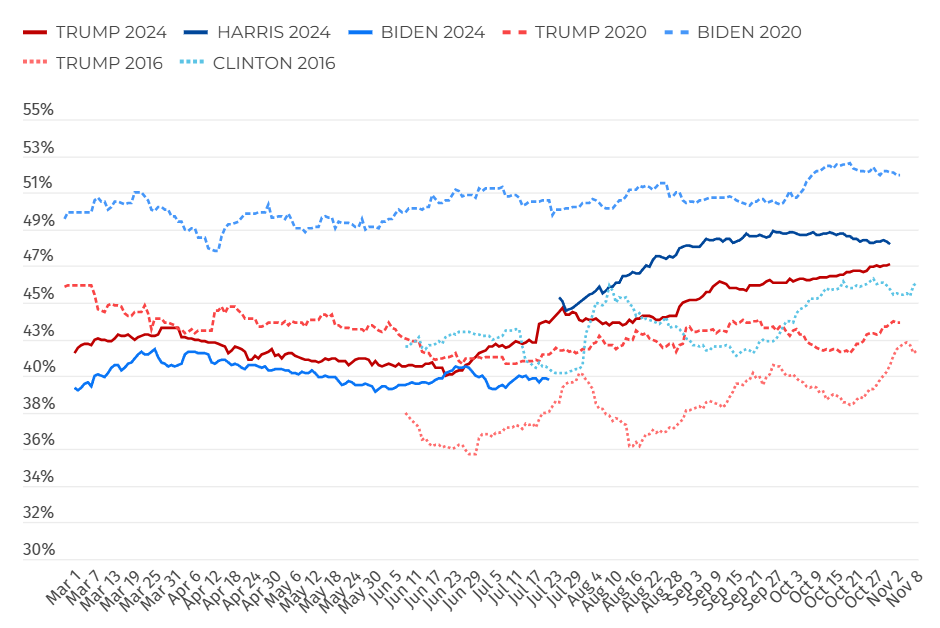

The 2024 U.S. presidential race is notably close, with Trump and Harris showing nearly even polling numbers, creating further uncertainty in financial markets. Betting platforms like Polymarket are reflecting higher odds of a Trump victory, further fueling crypto investments. The following table illustrates the average poll ratings for Trump and Harris as of recent months.

2024 U.S. Presidential Poll Averages (Selected Dates)

| Date | Trump (%) | Harris (%) |

|---|---|---|

| Oct 31 | 46.77 | 47.92 |

| Oct 25 | 46.61 | 48.01 |

| Oct 20 | 46.42 | 48.21 |

| Oct 10 | 46.00 | 48.45 |

| Oct 1 | 45.91 | 48.55 |

Data source: Major national poll averages, U.S. 2024 Presidential Election.

This close race reflects voter uncertainty, which in turn contributes to volatility in the markets, particularly in assets like Bitcoin, which are sensitive to political developments and regulatory outlooks.

Futures Markets Point to High Volatility During Election Week

The cryptocurrency futures market shows that traders are expecting high volatility around the election. Deribit, a leading crypto derivatives exchange, reports that implied volatility data signals potential daily Bitcoin price swings of around 3.7% through the election period. This volatility represents the degree of anticipated price movement as investors weigh the impacts of each candidate’s stance on cryptocurrency.

Increased trading activity is evident, with open interest on crypto derivatives exchanges reaching an all-time high of $43.61 billion on a recent Tuesday, according to Coinglass, a crypto market data provider. This surge in open interest suggests that investors are positioning themselves for substantial price moves in the days leading up to and following the election.

Also Read: Jupiter Wagons Shares Surge 5% Amid Acquisition of Log9’s Rail and EV Battery Business

Traders Anticipate Bitcoin Stability Post-Election

Despite the anticipated turbulence, some market participants expect Bitcoin’s price to stabilize and continue its upward trend after the election results are finalized. Luuk Strijers, CEO of Deribit, mentioned that while traders are preparing for election-related price swings, the expectation is for a reduction in volatility post-election, with Bitcoin likely resuming its growth trajectory.

As the election approaches, the crypto market faces a period of intense scrutiny, with investors, traders, and policymakers all attuned to the potential impact of political changes on digital assets.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!