Dhan has rapidly emerged as a prominent player in the Indian online stock trading and investing landscape, offering a robust platform for traders and investors alike. Tailored to meet the needs of both novice and seasoned market participants, Dhan provides a comprehensive suite of tools designed to enhance the trading experience. With features like real-time market data, advanced charting tools, and personalized investment insights, Dhan aims to empower users to make informed and strategic investment decisions.

This detailed review will delve into Dhan’s offerings, including its fee structure, security measures, and how it stacks up against other leading platforms in India. Whether you are new to trading or an experienced investor, understanding what Dhan has to offer can help you make the most of your investment journey.

What is Dhan?

Dhan is an innovative online stock trading and investing platform tailored for Indian investors. Launched with the vision to simplify trading and investing, Dhan provides a comprehensive suite of tools and resources to help users navigate the complexities of the stock market. This platform is designed to cater to both novice and experienced traders, offering features that enhance user experience and improve trading efficiency.

Dhan’s primary focus is to make investing in stocks, mutual funds, and other financial instruments accessible and straightforward. The platform is equipped with an intuitive user interface, robust trading tools, and extensive market research resources. These features enable users to make informed decisions and execute trades seamlessly. Additionally, Dhan offers real-time market data, advanced charting tools, and personalized investment insights, making it a one-stop solution for all trading and investment needs.

The platform’s commitment to user education and support sets it apart from other trading platforms. Dhan provides a wealth of educational resources, including webinars, tutorials, and articles, to help users build their trading skills and knowledge. This focus on education ensures that users are well-equipped to navigate the stock market and make informed investment decisions.

Dhan also prioritizes security and transparency, implementing stringent security measures to protect user data and transactions. The platform is compliant with regulatory standards and employs advanced encryption technologies to ensure the safety of user information.

In summary, Dhan is a comprehensive online stock trading and investing platform designed to cater to the diverse needs of Indian investors. With its user-friendly interface, advanced trading tools, and commitment to user education and security, Dhan is well-positioned to become a leading player in the Indian stock market.

Features of Dhan

Dhan offers a wide array of features designed to enhance the trading and investing experience for its users. These features are tailored to meet the needs of both novice and experienced traders, providing them with the tools and resources necessary to succeed in the stock market.

One of the standout features of Dhan is its intuitive user interface. The platform is designed to be user-friendly, with a clean and organized layout that makes navigation easy. Users can quickly access various sections of the platform, such as their portfolio, trading tools, and market research resources. This intuitive design ensures that users can efficiently execute trades and monitor their investments.

Dhan also offers a comprehensive suite of trading tools. These tools include real-time market data, advanced charting tools, and technical analysis indicators. Users can leverage these tools to conduct in-depth market analysis and make informed trading decisions. Additionally, Dhan provides personalized investment insights and recommendations, helping users identify potential investment opportunities.

Another notable feature of Dhan is its extensive market research resources. The platform provides users with access to a wealth of market data, including stock quotes, news updates, and financial reports. Users can stay informed about market trends and developments, enabling them to make timely and informed investment decisions.

Dhan also offers a range of educational resources to help users build their trading skills and knowledge. These resources include webinars, tutorials, and articles on various trading and investing topics. Users can access these resources to enhance their understanding of the stock market and develop effective trading strategies.

The platform also prioritizes security and transparency. Dhan implements advanced security measures to protect user data and transactions. These measures include encryption technologies, two-factor authentication, and regular security audits. Additionally, Dhan is compliant with regulatory standards, ensuring that user information is handled with the utmost care and confidentiality.

In conclusion, Dhan offers a comprehensive suite of features designed to enhance the trading and investing experience. With its intuitive user interface, advanced trading tools, extensive market research resources, and commitment to user education and security, Dhan is a robust platform that caters to the diverse needs of Indian investors.

Account Opening Process

Opening an account with Dhan is a straightforward and hassle-free process. The platform has streamlined the account opening procedure to ensure that users can quickly and easily get started with their trading and investing journey.

To begin the account opening process, users need to visit the Dhan website and click on the “Open Account” button. This will redirect them to an online registration form where they will be required to provide their personal information, including their name, email address, phone number, and PAN card details. Users will also need to create a username and password for their Dhan account.

After filling out the registration form, users will need to complete the KYC (Know Your Customer) verification process. This involves submitting scanned copies of their identity proof (such as an Aadhar card or passport) and address proof (such as a utility bill or bank statement). Dhan uses these documents to verify the user’s identity and ensure compliance with regulatory standards.

Once the KYC documents are submitted, users will need to complete the in-person verification (IPV) process. This can be done through a video call with a Dhan representative, where users will be asked to show their original documents for verification. The IPV process is quick and typically takes only a few minutes to complete.

After successful verification, users will receive a confirmation email from Dhan with their account details. They can then log in to their Dhan account and start trading and investing in the stock market.

Dhan also offers a range of account types to cater to different user needs. These include individual accounts, joint accounts, and corporate accounts. Users can choose the account type that best suits their requirements and start their trading journey with Dhan.

In summary, opening an account with Dhan is a simple and efficient process. The platform’s streamlined account opening procedure, combined with its commitment to regulatory compliance and user security, ensures that users can quickly and easily get started with their trading and investing activities.

Must Read: CoinDCX Review: An In-depth Analysis of India’s Leading Cryptocurrency Exchange in 2024

User Interface and Experience

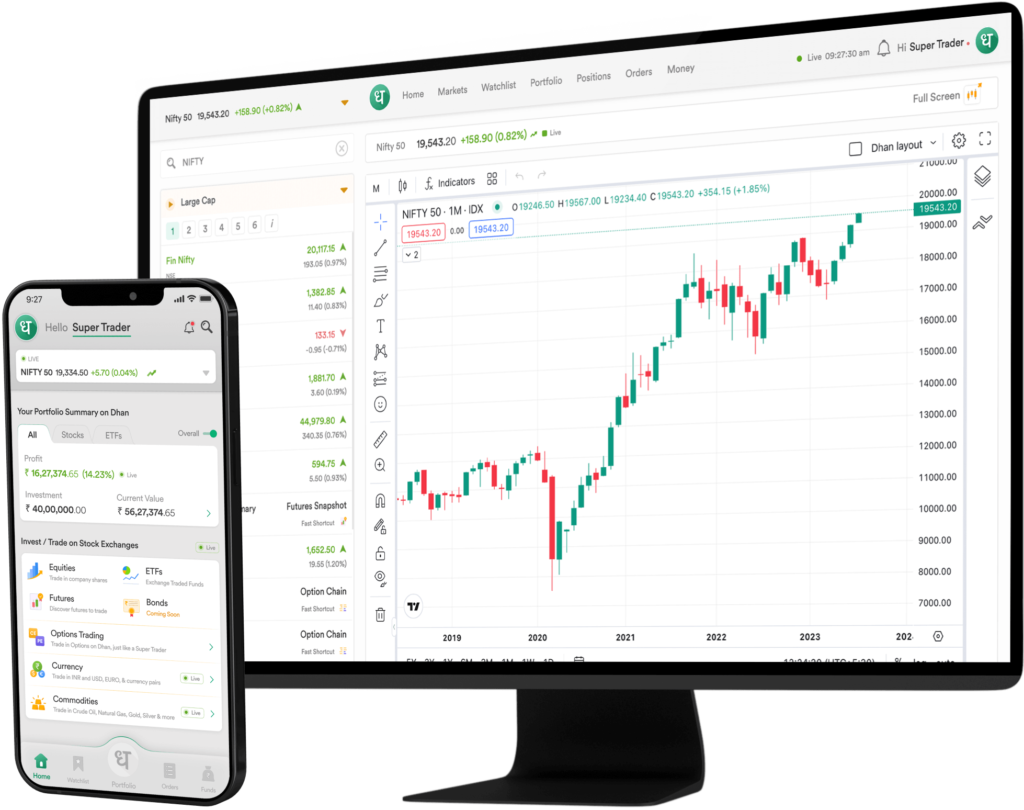

Dhan’s user interface is designed with the user in mind, offering a seamless and intuitive experience that caters to both novice and experienced traders. The platform’s clean and organized layout ensures that users can easily navigate through various sections and access the tools and resources they need.

The homepage provides a comprehensive overview of the user’s portfolio, including current holdings, recent transactions, and performance metrics. Users can quickly assess their portfolio’s performance and make informed decisions based on real-time data. The dashboard is customizable, allowing users to personalize their view and prioritize the information that matters most to them.

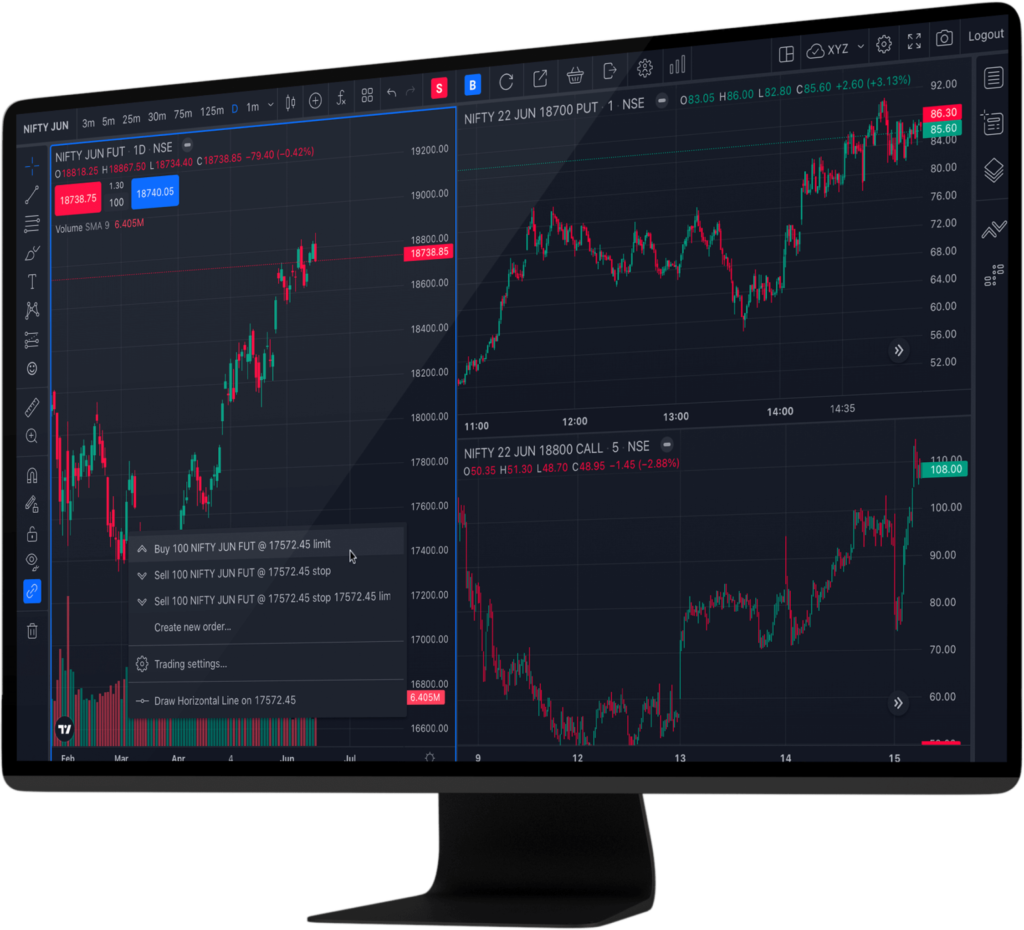

One of the standout features of Dhan’s user interface is its advanced charting tools. These tools provide users with detailed visual representations of market data, enabling them to conduct in-depth technical analysis. Users can customize the charts to display various indicators, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI). This level of customization allows users to tailor their analysis to their specific trading strategies and preferences.

In addition to advanced charting tools, Dhan offers a range of trading tools designed to enhance the user experience. These tools include real-time market data, news updates, and research reports. Users can access these tools to stay informed about market trends and developments, helping them make timely and informed trading decisions.

Dhan also prioritizes user experience by providing a seamless and efficient trading process. Users can execute trades with just a few clicks, thanks to the platform’s user-friendly design. The order placement process is straightforward, with clear instructions and prompts guiding users through each step. Additionally, Dhan offers various order types, including market orders, limit orders, and stop-loss orders, providing users with the flexibility to execute trades according to their specific strategies.

Another notable aspect of Dhan’s user interface is its mobile trading app. The app is designed to provide users with the same seamless and intuitive experience as the desktop platform. Users can access their accounts, execute trades, and monitor their portfolios on the go, ensuring that they never miss an investment opportunity. The mobile app is available for both iOS and Android devices, making it accessible to a wide range of users.

In conclusion, Dhan’s user interface and experience are designed to provide users with a seamless and efficient trading experience. The platform’s clean and organized layout, advanced charting tools, real-time market data, and mobile trading app ensure that users can easily navigate the platform and make informed trading decisions.

Trading Tools and Resources

Dhan offers a comprehensive suite of trading tools and resources designed to empower users and enhance their trading experience. These tools cater to the needs of both novice and experienced traders, providing them with the necessary information and insights to make informed decisions.

One of the key trading tools offered by Dhan is its real-time market data. Users can access up-to-the-minute stock quotes, market indices, and trading volumes, allowing them to stay informed about market movements and trends. This real-time data is crucial for making timely trading decisions and maximizing investment opportunities.

In addition to real-time market data, Dhan provides advanced charting tools that enable users to conduct detailed technical analysis. These tools offer a wide range of technical indicators, such as moving averages, MACD, RSI, and Bollinger Bands. Users can customize the charts to display these indicators and analyze historical price patterns. This in-depth analysis helps users identify potential entry and exit points, enhancing their trading strategies.

Dhan also offers personalized investment insights and recommendations. These insights are generated based on users’ trading patterns, portfolio composition, and market trends. Users receive tailored recommendations that align with their investment goals and risk tolerance. This personalized approach ensures that users can make informed decisions that suit their individual needs.

Another valuable resource provided by Dhan is its extensive library of educational materials. The platform offers webinars, tutorials, and articles on various trading and investing topics. These resources cover a wide range of subjects, including basic trading concepts, advanced technical analysis, and risk management strategies. Users can leverage these educational materials to enhance their knowledge and develop effective trading strategies.

Dhan also provides users with access to comprehensive market research reports. These reports include detailed analysis of specific stocks, sectors, and market trends. Users can use these reports to gain deeper insights into potential investment opportunities and make well-informed decisions. Additionally, Dhan offers news updates and financial reports, ensuring that users are always up-to-date with the latest market developments.

The platform also includes a range of risk management tools. These tools help users manage their risk exposure and protect their investments. For example, Dhan offers stop-loss orders, which automatically trigger the sale of a security when its price falls below a specified level. This feature helps users limit their losses and protect their capital.

In summary, Dhan offers a comprehensive suite of trading tools and resources designed to empower users and enhance their trading experience. With its real-time market data, advanced charting tools, personalized investment insights, educational materials, market research reports, and risk management tools, Dhan provides users with the information and insights they need to succeed in the stock market.

Also ReaD: A Beginners Guide to Stock Trading: Tips and Tricks [2024]

Fee Structure and Charges

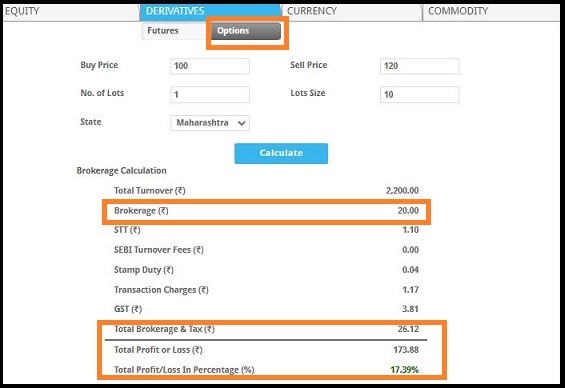

Understanding the fee structure and charges associated with using Dhan is crucial for users looking to maximize their returns and minimize their trading costs. Dhan offers a transparent and competitive fee structure, making it an attractive option for traders and investors.

Dhan charges a brokerage fee for executing trades on behalf of users. The brokerage fee is a percentage of the transaction value and varies depending on the type of security being traded. For equity delivery trades, Dhan charges a brokerage fee of 0.10% of the transaction value. For intraday trades, the brokerage fee is 0.01% of the transaction value. These rates are competitive compared to other online trading platforms, ensuring that users can trade cost-effectively.

In addition to brokerage fees, Dhan also charges a transaction fee for each trade executed. The transaction fee covers the costs associated with processing and executing the trade. This fee is typically a flat rate per trade, regardless of the transaction value. For example, Dhan charges a transaction fee of Rs. 20 per trade for equity delivery trades and Rs. 10 per trade for intraday trades.

Dhan also imposes regulatory charges, which are mandatory fees levied by regulatory authorities. These charges include the Securities Transaction Tax (STT), Goods and Services Tax (GST), and SEBI (Securities and Exchange Board of India) charges. The STT is a tax levied on the purchase and sale of securities, and its rate varies depending on the type of security and the nature of the trade. The GST is a tax on the supply of goods and services, and it is applied to the brokerage fee and transaction fee. SEBI charges are fees levied by the Securities and Exchange Board of India for regulating the securities market.

Another cost associated with using Dhan is the Demat account maintenance fee. Dhan charges an annual maintenance fee for maintaining the user’s Demat account, which is used to hold securities in electronic form. This fee is typically a flat rate, regardless of the number of securities held in the account. For example, Dhan charges an annual maintenance fee of Rs. 300 for individual Demat accounts.

Dhan also charges fees for additional services, such as margin trading and loan against securities. These fees vary depending on the type of service and the terms and conditions agreed upon by the user and Dhan. For example, margin trading fees may include interest charges on the borrowed amount, while loan against securities fees may include processing fees and interest charges.

In conclusion, Dhan offers a transparent and competitive fee structure that ensures users can trade cost-effectively. By understanding the various fees and charges associated with using Dhan, users can make informed decisions and maximize their returns.

Must Read: Stock Market for Beginners: How to Start Investing Today!

Security Measures

Security is a top priority for Dhan, and the platform implements a range of measures to protect user data and transactions. These security measures ensure that users can trade and invest with confidence, knowing that their information is secure.

One of the key security measures implemented by Dhan is advanced encryption technology. The platform uses industry-standard encryption protocols to protect user data during transmission and storage. This ensures that sensitive information, such as personal details and financial transactions, is encrypted and cannot be accessed by unauthorized parties.

Dhan also employs two-factor authentication (2FA) to enhance account security. With 2FA, users are required to provide two forms of identification to access their accounts. This typically includes a password and a verification code sent to the user’s mobile device. By requiring an additional layer of authentication, Dhan ensures that only authorized users can access their accounts.

Another important security measure implemented by Dhan is regular security audits. The platform conducts periodic audits to identify and address potential vulnerabilities in its systems. These audits are performed by internal security teams as well as external security experts. By proactively identifying and addressing security vulnerabilities, Dhan ensures that its systems remain secure and resilient against potential threats.

Dhan also complies with regulatory standards and guidelines to ensure the security and integrity of user data. The platform adheres to the data protection regulations set forth by regulatory authorities, such as the Securities and Exchange Board of India (SEBI). This includes implementing stringent data protection policies and procedures to safeguard user information.

In addition to these measures, Dhan provides users with tools to enhance their account security. For example, users can set up account alerts to receive notifications of suspicious activities, such as unauthorized login attempts or large transactions. These alerts enable users to take immediate action in case of potential security breaches.

Dhan also offers educational resources to help users protect their accounts and data. The platform provides articles and tutorials on best practices for online security, such as creating strong passwords, recognizing phishing attempts, and safeguarding personal information. By educating users on security best practices, Dhan empowers them to take an active role in protecting their accounts.

In conclusion, Dhan implements a range of security measures to protect user data and transactions. With advanced encryption technology, two-factor authentication, regular security audits, regulatory compliance, and user education, Dhan ensures that users can trade and invest with confidence, knowing that their information is secure.

Customer Support

Dhan places a strong emphasis on customer support, providing users with multiple channels to seek assistance and resolve issues. The platform’s customer support team is dedicated to ensuring that users have a smooth and satisfactory experience while using Dhan.

One of the primary channels for customer support is the Dhan Help Center. The Help Center is a comprehensive online resource that provides answers to frequently asked questions and detailed guides on various topics. Users can access the Help Center to find information on account setup, trading tools, fee structure, security measures, and more. The Help Center is organized in a user-friendly manner, making it easy for users to find the information they need.

In addition to the Help Center, Dhan offers live chat support. Users can access the live chat feature from the Dhan website or mobile app to connect with a customer support representative in real-time. The live chat support is available during business hours, and users can get immediate assistance for their queries or issues. The live chat feature is particularly useful for resolving urgent issues or getting quick answers to questions.

Dhan also provides email support for users who prefer to communicate via email. Users can send their queries or issues to the dedicated support email address, and the customer support team will respond within a specified timeframe. Email support is suitable for non-urgent issues or when users need to provide detailed information about their queries.

For more complex issues or personalized assistance, Dhan offers phone support. Users can contact the customer support team via phone to speak directly with a representative. Phone support is available during business hours, and users can get immediate assistance for their issues. This channel is particularly useful for resolving complex issues that require detailed explanations or step-by-step guidance.

Dhan also offers a community forum where users can interact with other Dhan users and share their experiences and insights. The community forum is a valuable resource for users to learn from each other and get tips and advice on trading and investing. The forum is moderated by the Dhan support team, ensuring that the information shared is accurate and reliable.

In addition to these support channels, Dhan is active on social media platforms, such as Twitter and Facebook. Users can follow Dhan on social media to stay updated on the latest news, updates, and announcements. Social media is also a convenient channel for users to reach out to the support team and get quick responses to their queries.

In summary, Dhan provides a robust customer support system with multiple channels for users to seek assistance and resolve issues. With the Help Center, live chat support, email support, phone support, community forum, and social media presence, Dhan ensures that users have access to the support they need to have a smooth and satisfactory experience.

Pros and Cons of Dhan

When evaluating any online stock trading and investing platform, it is essential to consider the pros and cons to determine if it meets your specific needs and preferences. Dhan has several advantages that make it an attractive option for Indian investors, as well as some drawbacks that users should be aware of.

Pros:

- User-Friendly Interface: Dhan’s intuitive and clean interface makes it easy for users to navigate the platform and access various features. Both novice and experienced traders can benefit from the straightforward design.

- Advanced Trading Tools: The platform offers a wide range of trading tools, including real-time market data, advanced charting tools, and technical analysis indicators. These tools enable users to conduct in-depth market analysis and make informed trading decisions.

- Comprehensive Market Research: Dhan provides users with access to extensive market research resources, including stock quotes, news updates, financial reports, and detailed analysis. This information helps users stay informed and make timely investment decisions.

- Educational Resources: Dhan offers a wealth of educational materials, such as webinars, tutorials, and articles, to help users build their trading skills and knowledge. This focus on education is beneficial for both beginners and experienced traders looking to enhance their understanding of the stock market.

- Competitive Fee Structure: Dhan’s transparent and competitive fee structure ensures that users can trade cost-effectively. The platform’s brokerage fees, transaction fees, and regulatory charges are in line with industry standards, making it an affordable option for traders and investors.

- Robust Security Measures: Dhan prioritizes security and implements advanced encryption technology, two-factor authentication, regular security audits, and compliance with regulatory standards. These measures ensure that user data and transactions are protected.

- Mobile Trading App: The Dhan mobile app provides users with the same seamless and intuitive experience as the desktop platform. Users can access their accounts, execute trades, and monitor their portfolios on the go, ensuring they never miss an investment opportunity.

- Customer Support: Dhan offers multiple channels for customer support, including a Help Center, live chat support, email support, phone support, community forum, and social media presence. This ensures that users can get the assistance they need in a timely manner.

Cons:

- Limited International Market Access: Dhan primarily focuses on the Indian stock market, which may be a limitation for users looking to invest in international markets. Users interested in global diversification may need to use additional platforms to access international stocks.

- Annual Maintenance Fee: Dhan charges an annual maintenance fee for maintaining Demat accounts. While this fee is standard across the industry, it is an additional cost that users should consider.

- Limited Account Types: Although Dhan offers individual, joint, and corporate accounts, it may not provide as many account options as some other platforms. Users with specific account requirements, such as trusts or pension accounts, may need to explore other options.

- In-Person Verification Requirement: The KYC and IPV process requires users to complete in-person verification through a video call. While this step is necessary for regulatory compliance, it may be inconvenient for some users.

- No Direct Mutual Fund Investments: Dhan currently does not offer direct mutual fund investment options. Users looking to invest in mutual funds may need to use a separate platform for this purpose.

In conclusion, Dhan offers several advantages, including a user-friendly interface, advanced trading tools, comprehensive market research, educational resources, competitive fee structure, robust security measures, a mobile trading app, and excellent customer support. However, users should also consider the limitations, such as limited international market access, annual maintenance fees, limited account types, in-person verification requirements, and the absence of direct mutual fund investments. By weighing these pros and cons, users can determine if Dhan is the right platform for their trading and investing needs.

Also Read: Why Now Is the Best Time to Dive into the Stock Market!

Mobile Trading App Review

The Dhan mobile trading app is designed to provide users with a seamless and efficient trading experience on the go. Available for both iOS and Android devices, the app offers a range of features and tools that allow users to manage their investments and execute trades from anywhere.

One of the standout features of the Dhan mobile app is its user-friendly interface. The app’s design is clean and intuitive, making it easy for users to navigate through various sections. The homepage provides an overview of the user’s portfolio, including current holdings, recent transactions, and performance metrics. Users can quickly assess their portfolio’s performance and make informed decisions based on real-time data.

The Dhan mobile app offers a comprehensive suite of trading tools, similar to the desktop platform. Users can access real-time market data, advanced charting tools, and technical analysis indicators directly from their mobile devices. The app’s charting tools are particularly impressive, offering a wide range of customization options. Users can apply various technical indicators, such as moving averages and RSI, to conduct in-depth market analysis.

In addition to advanced charting tools, the Dhan mobile app provides personalized investment insights and recommendations. These insights are generated based on the user’s trading patterns and portfolio composition, helping users identify potential investment opportunities. The app also offers news updates and market research reports, ensuring that users stay informed about market trends and developments.

The order placement process on the Dhan mobile app is straightforward and efficient. Users can execute trades with just a few taps, thanks to the app’s user-friendly design. The app supports various order types, including market orders, limit orders, and stop-loss orders, providing users with the flexibility to execute trades according to their specific strategies.

Security is a top priority for the Dhan mobile app. The app uses advanced encryption technology to protect user data during transmission and storage. Additionally, the app supports two-factor authentication (2FA), adding an extra layer of security to the login process. Users can also set up account alerts to receive notifications of suspicious activities, such as unauthorized login attempts or large transactions.

The Dhan mobile app also offers a range of account management features. Users can view their account balance, transaction history, and trade confirmations directly from the app. The app also supports fund transfers, allowing users to transfer funds between their trading account and bank account seamlessly.

One of the notable advantages of the Dhan mobile app is its performance and speed. The app is optimized for mobile devices, ensuring that users can access real-time data and execute trades without any delays. This performance is crucial for traders who need to make quick decisions based on market movements.

In conclusion, the Dhan mobile trading app offers a seamless and efficient trading experience for users on the go. With its user-friendly interface, advanced trading tools, personalized investment insights, robust security measures, and efficient order placement process, the app provides users with everything they need to manage their investments and execute trades from anywhere. Whether you are a novice or an experienced trader, the Dhan mobile app is a valuable tool for your trading and investing activities.

Comparing Dhan with Other Platforms

When choosing an online stock trading and investing platform, it is important to compare different options to determine which one best meets your needs. Dhan is a competitive platform with several advantages, but it is also helpful to compare it with other popular platforms in the Indian market, such as Zerodha, Upstox, and Angel Broking.

Dhan vs. Zerodha:

- User Interface: Both Dhan and Zerodha offer user-friendly interfaces, but Dhan’s interface is often praised for its clean and intuitive design. Zerodha’s interface is also well-regarded, but some users find it slightly more complex to navigate.

- Trading Tools: Dhan and Zerodha both provide advanced trading tools, including real-time market data, charting tools, and technical analysis indicators. Zerodha’s Kite platform is particularly known for its robust trading tools, while Dhan also offers a comprehensive suite of tools that cater to both novice and experienced traders.

- Fee Structure: Zerodha is known for its discount brokerage model, offering low brokerage fees. Dhan’s fee structure is competitive, but Zerodha’s rates are generally lower for high-frequency traders. However, Dhan offers a transparent fee structure that includes all costs upfront.

- Educational Resources: Both platforms offer educational resources, but Dhan places a stronger emphasis on user education with its extensive library of webinars, tutorials, and articles. Zerodha also provides educational content through its Varsity platform, which is well-regarded in the industry.

- Customer Support: Dhan offers multiple channels for customer support, including live chat, email, phone support, and a community forum. Zerodha primarily relies on its online support portal and email support, which some users find less responsive.

Dhan vs. Upstox:

- User Interface: Both Dhan and Upstox offer user-friendly interfaces, but Dhan’s interface is often considered more intuitive and easier to navigate. Upstox’s interface is also well-designed, but some users find it less seamless compared to Dhan.

- Trading Tools: Upstox provides a range of trading tools, including advanced charting and technical analysis features. Dhan offers similar tools, but also includes personalized investment insights and recommendations, which some users find more valuable.

- Fee Structure: Upstox is known for its competitive brokerage fees, particularly for intraday trading. Dhan’s fee structure is also competitive, but Upstox may have an edge for cost-conscious traders. Both platforms offer transparent fee structures.

- Educational Resources: Dhan offers a comprehensive range of educational resources, while Upstox also provides educational content but with a slightly narrower focus. Dhan’s emphasis on user education is a notable advantage.

- Customer Support: Dhan provides multiple support channels, including live chat and phone support. Upstox offers support through its online help center and email, but some users find Dhan’s support options more accessible and responsive.

Dhan vs. Angel Broking:

- User Interface: Both Dhan and Angel Broking offer user-friendly interfaces, but Dhan’s design is often considered more modern and intuitive. Angel Broking’s interface is functional but may feel slightly dated to some users.

- Trading Tools: Angel Broking offers a range of trading tools, including advanced charting and technical analysis features. Dhan’s trading tools are comparable, but Dhan also offers personalized investment insights and a more seamless mobile trading experience.

- Fee Structure: Angel Broking offers competitive brokerage fees, particularly for new clients through its Angel iTrade PRIME plan. Dhan’s fee structure is also competitive and transparent, making it an attractive option for cost-conscious traders.

- Educational Resources: Both platforms offer educational resources, but Dhan’s extensive library of webinars, tutorials, and articles provides a more comprehensive learning experience. Angel Broking also provides educational content, but Dhan’s focus on education is more pronounced.

- Customer Support: Dhan offers multiple support channels, including live chat, phone support, and a community forum. Angel Broking provides support through its online help center, email, and phone, but Dhan’s support options are often considered more accessible and responsive.

In conclusion, Dhan is a competitive online stock trading and investing platform with several advantages, including a user-friendly interface, advanced trading tools, comprehensive educational resources, a competitive fee structure, and robust customer support. When comparing Dhan with other popular platforms like Zerodha, Upstox, and Angel Broking, it is clear that Dhan holds its own and offers unique features that cater to a wide range of traders and investors. Ultimately, the choice of platform will depend on individual preferences and specific trading needs.

Conclusion

Dhan is an online stock trading and investing platform that offers a wide range of features and tools designed to meet the needs of Indian investors. With its user-friendly interface, advanced trading tools, comprehensive market research, educational resources, competitive fee structure, robust security measures, and excellent customer support, Dhan provides users with a seamless and efficient trading experience.

The platform’s emphasis on user education, personalized investment insights, and intuitive design makes it an attractive option for both novice and experienced traders. Additionally, Dhan’s mobile trading app ensures that users can manage their investments and execute trades on the go, providing flexibility and convenience.

While Dhan has several advantages, it is important to consider the limitations, such as limited international market access, annual maintenance fees, limited account types, in-person verification requirements, and the absence of direct mutual fund investments. By weighing these pros and cons, users can determine if Dhan is the right platform for their trading and investing needs.

Overall, Dhan is a competitive and reliable platform that empowers users to make informed investment decisions and achieve their financial goals. Whether you are a beginner looking to learn the basics of stock trading or an experienced trader seeking advanced tools and resources, Dhan offers a comprehensive solution for your trading and investing needs.

Must Read: How to Make Your First Million in the Stock Market – Secrets Revealed!

Frequently Asked Questions (FAQs)

What is Dhan, and how does it work?

Dhan is an online stock trading and investing platform designed for Indian investors. It provides users with tools and resources to trade in the stock market, including real-time market data, advanced charting tools, and personalized investment insights. Users can open an account, access various trading features, execute trades, and manage their portfolios through Dhan’s user-friendly interface. The platform supports equity trading, technical analysis, and offers educational materials to help users make informed investment decisions.

What are the fees and charges associated with using Dhan?

Dhan has a transparent and competitive fee structure. Brokerage fees for equity delivery trades are 0.10% of the transaction value, while intraday trades incur a brokerage fee of 0.01%. In addition to brokerage fees, Dhan charges a transaction fee of Rs. 20 per trade for equity delivery trades and Rs. 10 per trade for intraday trades. Users are also responsible for regulatory charges, including Securities Transaction Tax (STT), Goods and Services Tax (GST), and SEBI charges. There is an annual maintenance fee of Rs. 300 for Demat accounts. Additional fees may apply for services like margin trading and loans against securities.

How secure is Dhan for trading and investing?

Dhan prioritizes security with several measures to protect user data and transactions. The platform uses advanced encryption technology to safeguard data during transmission and storage. Two-factor authentication (2FA) adds an extra layer of security, requiring users to provide a password and a verification code to access their accounts. Regular security audits and compliance with regulatory standards, such as those set by the Securities and Exchange Board of India (SEBI), further ensure the security and integrity of user information.

Does Dhan offer a mobile trading app, and what features does it include?

Yes, Dhan offers a mobile trading app available for both iOS and Android devices. The app provides a user-friendly interface with features similar to the desktop platform. Users can access real-time market data, advanced charting tools, and technical analysis indicators. The app also supports order placement, personalized investment insights, news updates, and account management. Security features, such as advanced encryption and two-factor authentication, are integrated into the mobile app to ensure safe trading and account protection.

How does Dhan compare with other trading platforms like Zerodha or Upstox?

Dhan is a competitive platform with features that compare favorably with other popular trading platforms such as Zerodha, Upstox, and Angel Broking. Dhan’s user-friendly interface, advanced trading tools, and comprehensive educational resources are among its strengths. While Zerodha is known for its low brokerage fees and Upstox for its competitive pricing, Dhan offers a transparent fee structure and robust customer support. Each platform has its unique advantages, so the best choice depends on individual preferences, trading needs, and desired features.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!