Ford Stock Analysis: When it comes to investing in the stock market, understanding the long-term potential of a company is crucial. Today, we dive into an in-depth analysis of Ford’s stock, providing projections from 2024 all the way to 2050. This article covers historical performance, current market position, industry trends, future projections, and strategic initiatives.

Historical Performance of Ford Stock

Overview of Past Decades

Ford, an iconic name in the automotive industry, has experienced its fair share of ups and downs. From the innovation of the Model T to the challenges of the 2008 financial crisis, Ford’s journey is a testament to resilience and adaptability. Historically, Ford stock has mirrored these fluctuations, showing periods of growth and decline.

Key Milestones and Their Impact

Key milestones such as the launch of the Mustang, the transition to electric vehicles, and strategic alliances have significantly impacted Ford stock. For instance, the introduction of the F-150 Lightning, an all-electric version of their best-selling truck, marked a significant turning point, reflecting Ford’s commitment to future-proofing its brand.

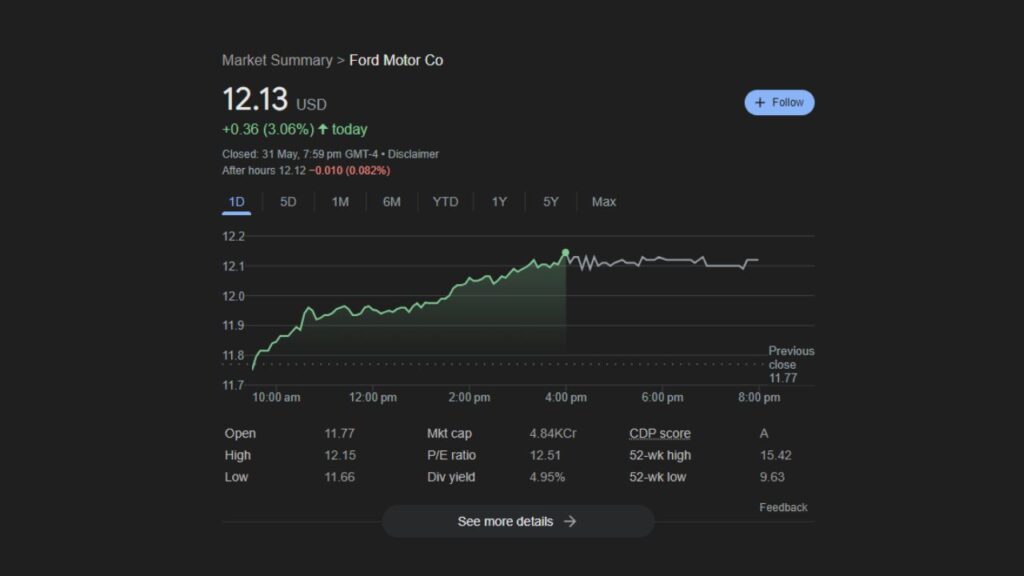

Current Market Position of Ford

Financial Health and Recent Earnings

Currently, Ford is on a solid financial footing. The company’s latest earnings reports indicate strong revenue growth, driven by an increasing demand for both traditional and electric vehicles. Ford’s ability to manage debt and maintain healthy cash flow positions it well against competitors.

Market Share and Competition

Ford holds a substantial market share, particularly in the truck and SUV segments. However, competition is fierce with companies like Tesla, General Motors, and emerging EV startups pushing the envelope. Ford’s ability to innovate and adapt to market changes will be crucial in maintaining its competitive edge.

Industry Trends and Their Impact on Ford

Rise of Electric Vehicles (EVs)

The automotive industry is undergoing a seismic shift towards electric vehicles. For Ford, this trend represents both a challenge and an opportunity. Investments in EV technology, like the development of the Mustang Mach-E and the F-150 Lightning, showcase Ford’s strategic pivot towards a more sustainable future.

Autonomous Driving Technology

Autonomous driving technology is another critical trend. Ford’s collaborations with tech companies and significant investment in research and development highlight their commitment to being at the forefront of this innovation. The potential for autonomous vehicles to revolutionize transportation could significantly impact Ford’s stock in the long term.

Projections for 2024–2030

Short-Term Growth Drivers

In the near term, Ford’s growth will likely be driven by its expanding EV lineup, continued dominance in the truck market, and strategic partnerships. Government incentives for electric vehicles and growing consumer demand for greener options also play pivotal roles.

Potential Risks and Challenges

However, risks such as supply chain disruptions, increased competition, and technological hurdles in EV and autonomous vehicle development could pose challenges. Additionally, economic fluctuations and regulatory changes can impact performance.

Projections for 2031-2040

Mid-Term Growth Drivers

Moving into the 2030s, Ford’s success will hinge on scaling production of EVs and capturing a significant market share in autonomous vehicles. International expansion, particularly in emerging markets, could offer substantial growth opportunities.

Potential Risks and Challenges

Mid-term challenges include managing the transition from internal combustion engines to EVs, navigating geopolitical tensions that may affect supply chains, and staying ahead in the technology race.

Must Read: 10 Surprising Stock Market Tips Every Investor Needs to Know!

Projections for 2041-2050

Long-Term Growth Drivers

In the long term, Ford’s vision of a fully autonomous and electric future will be the main growth driver. Innovations in battery technology, sustainable manufacturing practices, and new business models like subscription services for autonomous vehicles could revolutionize the industry.

Potential Risks and Challenges

Long-term risks involve technological obsolescence, potential regulatory changes, and environmental challenges. Keeping pace with rapid advancements in technology and changing consumer preferences will be vital.

Strategic Initiatives and Innovations

Investment in EVs

Ford’s substantial investment in electric vehicles is a cornerstone of its strategy. The company aims to have 40% of its global vehicle volume to be all-electric by 2030. This includes ramping up production capacities and securing battery supply chains.

Technological Advancements

Ford is also heavily investing in technological advancements such as AI, connectivity, and mobility solutions. The development of FordPass, an all-in-one app for vehicle management, and ventures into autonomous ride-hailing services highlight their innovative approach.

Also Read: How to Predict Stock Market Trends Like a Pro in India (2024)

Expert Opinions and Analyst Forecasts

Bullish Predictions

Many analysts are bullish on Ford, citing its aggressive push into EVs and strong financial health. Projections indicate that Ford stock could see substantial growth, driven by new product launches and market expansion.

Bearish Predictions

On the other hand, some analysts remain cautious, pointing to the high costs associated with transitioning to EVs and potential market saturation. They argue that while Ford’s strategy is sound, execution risks remain.

Also Read: 5 Expert Tips to Master Stock Market Volatility

Conclusion

Ford’s journey from 2024 to 2050 is poised to be transformative. The company’s strategic pivot towards electric and autonomous vehicles, coupled with its strong market position, makes it a compelling investment option. However, investors should remain mindful of the inherent risks and keep an eye on industry trends and technological advancements.

FAQs

1. What are the main growth drivers for Ford in the short term?

In the short term, Ford’s growth will be driven by its expanding electric vehicle lineup, dominance in the truck market, and strategic partnerships.

2. How is Ford positioning itself in the electric vehicle market?

Ford is making significant investments in electric vehicle technology, aiming to have 40% of its global vehicle volume be all-electric by 2030, with models like the Mustang Mach-E and the F-150 Lightning.

3. What are the potential risks to Ford’s long-term projections?

Potential risks include technological obsolescence, regulatory changes, supply chain disruptions, and increased competition.

4. How does Ford plan to stay competitive in the autonomous vehicle space?

Ford is investing heavily in autonomous driving technology and partnering with tech companies to stay at the forefront of innovation in this space.

5. What are analysts’ views on Ford’s future performance?

Analysts are divided; some are bullish due to Ford’s strong financial health and strategic initiatives, while others are cautious about the costs and execution risks associated with the transition to electric and autonomous vehicles.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!