Are you a keen investor looking into Grange Resources Limited (GRR) and wondering about their dividends? You’re in the right place. Dividends can be a critical part of your investment strategy, providing a steady income stream. In this article, we’ll break down everything you need to know about GRR’s dividends, from key dates to recent trends, and how they compare in the industry.

Understanding Dividends

What are Dividends?

Dividends are payments made by a corporation to its shareholders, usually derived from profits. They can be issued in the form of cash, additional stock, or other property.

Importance of Dividends

Dividends are important because they provide investors with a regular income and reflect the company’s profitability and financial health. They can be particularly attractive to long-term investors looking for stable returns.

Overview of Grange Resources Limited (GRR)

Company Background

Grange Resources Limited is an Australian-based mining company known for its significant operations in iron ore. With a strong presence in the industry, GRR has built a reputation for reliable production and robust financial management.

Financial Performance

GRR’s financial performance has shown consistent strength, underpinned by stable commodity prices and efficient operations. This performance is crucial, as it directly impacts their ability to pay dividends.

GRR’s Dividend History

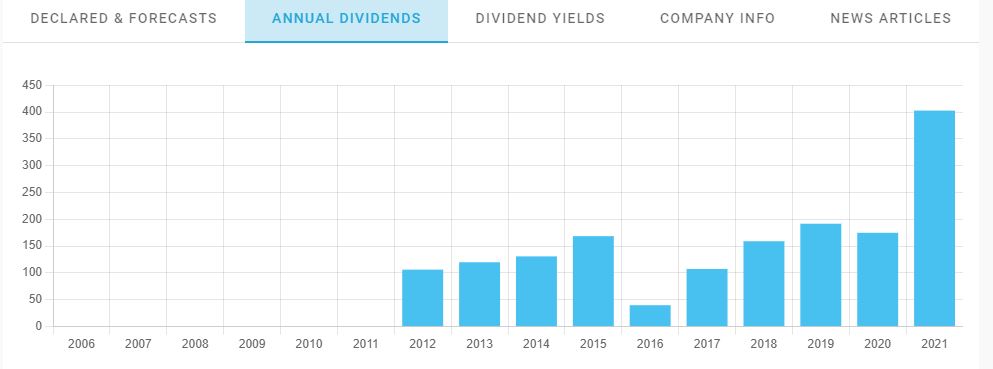

Historical Dividend Payouts

Over the years, GRR has maintained a steady dividend payout, reflecting its stable earnings. The company has a history of rewarding shareholders, which is a good indicator of financial health and management’s commitment to returning value to investors.

Frequency of Dividends

Typically, GRR pays dividends semi-annually, aligning with its financial reporting periods. This regular payout schedule provides predictability for investors.

Key Dates for GRR Dividends

Announcement Date

The announcement date is when GRR publicly declares its intention to pay a dividend. This date is critical as it provides investors with insights into the company’s financial health and future prospects.

Ex-Dividend Date

The ex-dividend date is the cutoff for investors to be eligible for the upcoming dividend. If you purchase GRR shares on or after this date, you won’t receive the dividend. This date usually falls a few days before the record date.

Record Date

The record date is when GRR determines which shareholders are entitled to receive the dividend. You must be on the company’s books as a shareholder by this date to get the dividend payout.

Payment Date

The payment date is when GRR distributes the dividend to shareholders. This is the day investors look forward to as they receive their earnings.

Trends in GRR’s Dividends

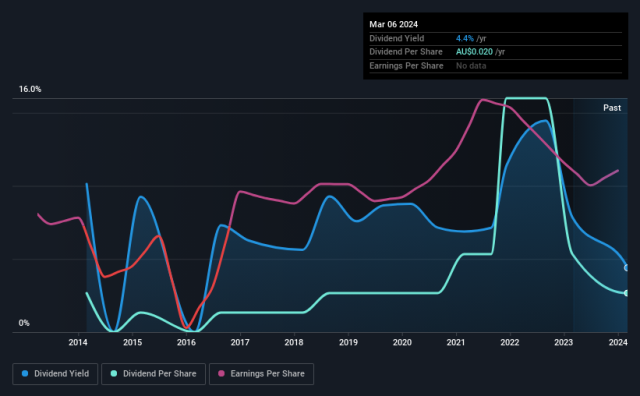

Recent Trends

Recently, GRR has been consistent with its dividend payouts, reflecting its stable earnings and prudent financial management. The dividends have been relatively stable, showing slight increments aligned with the company’s performance.

Factors Influencing Trends

Several factors influence GRR’s dividend trends, including market conditions, commodity prices, and overall company performance. Additionally, global economic conditions and industry trends also play a role.

Also Read: Ford Stock Analysis: Long-Term Projections for 2024 to 2050

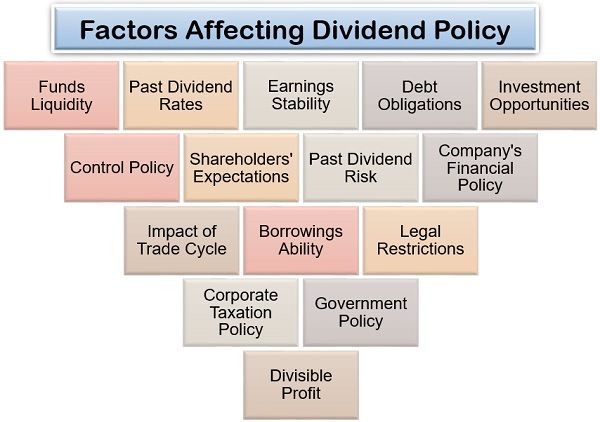

Factors Affecting GRR’s Dividend Policy

Market Conditions

The state of the market significantly impacts GRR’s ability to pay dividends. During robust economic periods, the company may generate higher profits, enabling larger payouts.

Company Earnings

GRR’s earnings are a direct determinant of its dividend policy. Strong earnings growth often leads to higher dividends, while weaker earnings can result in lower payouts or even a temporary halt in dividends.

Industry Trends

Trends within the mining industry, such as changes in commodity prices or shifts in demand and supply, can affect GRR’s dividend payouts. Staying attuned to these trends can provide insights into future dividend expectations.

How to Stay Informed About GRR Dividends

Company Announcements

Keep an eye on GRR’s official announcements, which are typically published on their website and through financial news outlets. These announcements will give you the most accurate and timely information regarding dividends.

Financial News

Subscribing to financial news services can help you stay updated on GRR’s performance and dividend announcements. These services often provide analysis and insights that can aid your investment decisions.

Investor Relations

GRR’s investor relations section on their website is a valuable resource. It offers comprehensive details about dividends, including historical data and future announcements.

Comparing GRR Dividends to Industry Peers

Industry Benchmarking

Benchmarking GRR’s dividends against industry peers helps assess their competitiveness. By comparing payout ratios, yield, and frequency, investors can gauge GRR’s position in the market.

Competitive Analysis

A detailed competitive analysis involves looking at how GRR’s dividends stack up against similar companies. This analysis can reveal strengths and weaknesses in GRR’s dividend policy.

Tips for Dividend Investors

Research and Analysis

Conduct thorough research and analysis before investing. Understand the company’s financials, dividend history, and future prospects. This approach helps make informed investment decisions.

Diversification

Diversifying your investment portfolio can mitigate risk. Including a mix of dividend-paying stocks across different industries ensures a steady income stream and reduces dependency on a single company.

Must Read: 5 Expert Tips to Master Stock Market Volatility

Conclusion

In conclusion, Grange Resources Limited (GRR) has a strong track record of paying dividends, making it an attractive option for dividend investors. By understanding the key dates, trends, and factors influencing their dividends, you can make informed decisions and maximize your investment returns. Stay updated through company announcements and financial news to keep abreast of any changes.

FAQs

When is the next GRR dividend payment?

The exact date can vary, but GRR typically announces their payment dates well in advance. Check their official announcements or financial news for the latest information.

How can I find out about GRR’s dividend announcements?

You can find GRR’s dividend announcements on their official website, through financial news services, and in their investor relations section.

What factors influence GRR’s dividend payouts?

Factors influencing GRR’s dividend payouts include market conditions, company earnings, and industry trends. Monitoring these can provide insights into future payouts.

How does GRR’s dividend compare to other companies in the industry?

GRR’s dividend competitiveness can be assessed through industry benchmarking and competitive analysis, comparing payout ratios, yield, and frequency with peers.

Is GRR a good stock for dividend investors?

GRR is considered a good stock for dividend investors due to its consistent payout history and stable financial performance. However, always conduct thorough research before investing.