Introduction

Diversification is a fundamental principle in investing that can help manage risk and optimize returns. When it comes to diversifying your portfolio, ASX shares offer a compelling opportunity for Australian investors. In this article, we’ll explore the ins and outs of diversifying with ASX shares, from understanding the basics to implementing effective strategies.

Understanding ASX Shares

What are ASX shares?

ASX shares refer to stocks listed on the Australian Securities Exchange (ASX), which is one of the world’s leading financial marketplaces. These shares represent ownership in Australian companies, spanning various industries and sectors.

Benefits of investing in ASX shares

Investing in ASX shares provides several advantages, including potential capital appreciation, dividend income, and the opportunity to participate in the growth of the Australian economy.

Risks associated with ASX shares

However, it’s essential to acknowledge the risks involved, such as market volatility, economic downturns, and company-specific factors that can impact share prices.

Factors to Consider Before Investing

Before diving into ASX shares, investors should assess their risk tolerance, define their investment goals, and determine their time horizon. These factors will guide the decision-making process and help build a diversified portfolio aligned with individual needs and preferences.

Strategies for Diversifying with ASX Shares

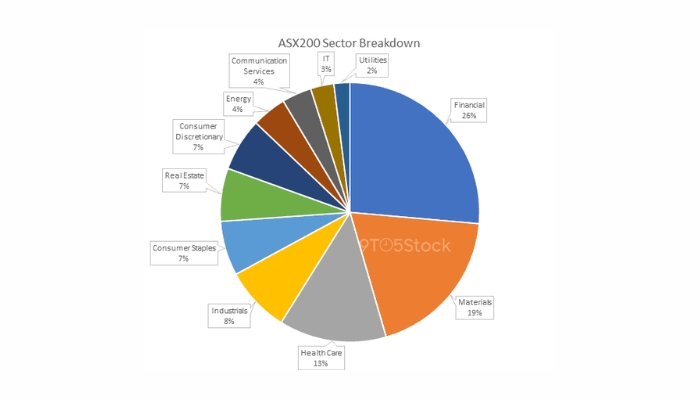

Sector diversification

Diversifying across different sectors, such as finance, healthcare, and technology, can reduce concentration risk and enhance portfolio resilience to sector-specific events.

Size diversification

Investors can also diversify by investing in companies of various sizes, including large-cap, mid-cap, and small-cap stocks. Each category offers unique growth potential and risk characteristics.

Geographical diversification

In addition to domestic exposure, investors can broaden their portfolio’s geographic footprint by including ASX shares with international operations. This diversification can mitigate country-specific risks and tap into global growth opportunities.

Researching ASX Shares

Fundamental analysis

Conducting thorough fundamental analysis involves evaluating a company’s financial health, management team, competitive position, and growth prospects. This approach helps investors assess the intrinsic value of ASX shares.

Technical analysis

Technical analysis focuses on analyzing price charts and market indicators to identify trends, patterns, and potential entry or exit points. While not predictive, technical analysis can provide valuable insights into market sentiment and investor behavior.

Market trends

Staying informed about market trends, macroeconomic indicators, and industry developments is essential for making informed investment decisions. Keeping a pulse on market news and expert opinions can help investors navigate changing market conditions effectively.

Building Your ASX Portfolio

Once armed with research and insights, investors can start building their ASX portfolio by selecting a diversified mix of shares. Regularly monitoring and adjusting the portfolio based on changing market dynamics and individual circumstances is crucial for long-term success.

Case Studies

Examining real-life examples of diversified ASX portfolios and learning from successful investors can offer valuable lessons and inspiration for investors at all levels.

Conclusion

In conclusion, diversifying your portfolio with ASX shares is a prudent strategy for managing risk and enhancing returns. By understanding the basics, implementing effective strategies, and staying disciplined, investors can build robust portfolios tailored to their financial goals and aspirations.

Must Read:

- Grange Resources Limited (GRR) Dividend Breakdown: Dates and Trends You Need to Know

- Investing in Lithium: Top 5 ASX Lithium Stocks for 2024

FAQs

How many ASX shares should I have in my portfolio?

The optimal number of ASX shares depends on various factors, including your investment goals, risk tolerance, and portfolio size. Generally, experts recommend holding a diversified mix of at least 15 to 20 stocks for adequate risk management.

Are ASX shares suitable for beginner investors?

While investing in ASX shares can be rewarding, it’s essential for beginner investors to educate themselves, conduct thorough research, and start with a diversified approach. Consulting with a financial advisor or using reputable investment resources can also help navigate the complexities of the market.

What are some common mistakes to avoid when investing in ASX shares?

Common mistakes include over-concentration in a single stock or sector, neglecting diversification, timing the market, and letting emotions dictate investment decisions. It’s crucial to approach investing with a long-term perspective, discipline, and a well-defined strategy.

How often should I review my ASX portfolio?

Regular portfolio reviews are essential to ensure alignment with your investment objectives and market conditions. Depending on your preferences and market volatility, consider conducting quarterly or semi-annual portfolio reviews to rebalance and adjust as needed.

Where can I find reliable information about ASX shares?

There are several reputable sources for researching ASX shares, including financial news websites, company annual reports, analyst reports, and investment platforms. It’s essential to verify information from multiple sources and consider the credibility and expertise of the information provider.

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute financial advice or recommendations to buy, sell, or hold any investment products. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not liable for any losses or damages incurred from the use of this information.