Dollar-Cost Averaging (DCA) is a strategic investment approach designed to mitigate the effects of market volatility. This method involves regularly investing a fixed amount of money into a particular asset or portfolio, regardless of the asset’s price. By doing so, investors purchase more shares when prices are low and fewer shares when prices are high. Over time, this can result in a lower average cost per share, potentially leading to greater long-term gains.

Understanding Dollar-Cost Averaging

Dollar-Cost Averaging (DCA) is a time-tested investment strategy that reduces the impact of volatility on your investment portfolio. By investing a fixed amount of money at regular intervals, investors avoid the pitfalls of trying to time the market, which can lead to suboptimal results. The core idea is that, over time, the average cost per share of an investment will smooth out, potentially leading to more favorable returns compared to making a lump-sum investment.

DCA can be particularly effective in volatile markets. For instance, during market downturns, the fixed investment amount will buy more shares at lower prices. Conversely, during uptrends, the same investment buys fewer shares at higher prices. This results in an average cost per share that is often lower than if the investment had been made all at once.

How Dollar-Cost Averaging Works?

To illustrate how DCA works, consider an investor who decides to invest $500 every month into a mutual fund. Suppose the share price of the fund fluctuates each month as follows:

| Month | Share Price | Shares Purchased | Total Investment |

|---|---|---|---|

| Jan | $50 | 10 | $500 |

| Feb | $40 | 12.5 | $500 |

| Mar | $45 | 11.11 | $500 |

| Apr | $55 | 9.09 | $500 |

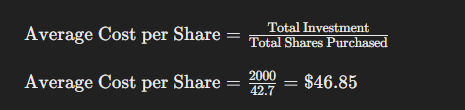

At the end of four months, the total shares purchased are 42.7, and the total investment is $2000. The average cost per share is calculated as:

This averaging effect can lead to a more stable investment outcome over time, especially when markets are highly unpredictable.

Benefits of Dollar-Cost Averaging

Dollar-Cost Averaging offers several notable benefits:

- Reduced Impact of Volatility: By spreading out investments, DCA helps to mitigate the effects of short-term market fluctuations.

- Disciplined Investment: Regular investments enforce a disciplined approach, helping investors avoid emotional decision-making.

- Avoiding Market Timing: DCA removes the need to predict market highs and lows, reducing the risk of poor timing.

- Long-Term Growth: Historically, DCA has helped many investors build substantial wealth over the long term.

Also Read: How to Invest in Foreign Markets Safely?

Common Misconceptions about Dollar-Cost Averaging

Despite its benefits, there are several misconceptions about DCA:

It Guarantees Profits: While DCA reduces the risk of investing all at once, it doesn’t guarantee profits. Market conditions can still impact returns.

It’s a Short-Term Strategy: DCA is designed for long-term investing. Short-term fluctuations can still impact results.

It’s Only for Volatile Markets: DCA can be effective in any market condition, not just volatile ones.

Implementing Dollar-Cost Averaging

Implementing DCA involves setting up a consistent investment plan. Here are the steps:

- Determine Investment Amount: Decide how much money you want to invest regularly.

- Choose Investment Vehicle: Select a mutual fund, stock, or ETF that suits your investment goals.

- Set Up Automatic Investments: Use brokerage accounts or investment platforms to automate your investments.

- Review Periodically: Regularly review your investment strategy and adjust as necessary based on your financial goals.

Dollar-Cost Averaging vs. Lump-Sum Investing

Dollar-Cost Averaging is often compared to Lump-Sum Investing, where a large amount is invested at once. Each approach has its advantages:

Dollar-Cost Averaging: Reduces the risk of investing a large sum just before a market decline. It’s ideal for investors who prefer a more controlled approach.

Lump-Sum Investing: Can outperform DCA in rising markets, as all funds are invested at once and have more time to grow.

Case Studies of Successful Dollar-Cost Averaging

Numerous case studies highlight the success of Dollar-Cost Averaging:

The 2008 Financial Crisis: Investors who used DCA during this period often saw better returns than those who invested a lump sum just before the crisis.

Long-Term Retirement Plans: Many retirement accounts benefit from DCA, as consistent contributions build wealth over decades.

Risks and Considerations

While DCA has benefits, it also comes with risks:

- Market Conditions: Prolonged bear markets can still negatively impact returns.

- Opportunity Costs: DCA might lead to missed opportunities if the market performs well during the investment period.

- Investment Choices: Selecting the right investment vehicle is crucial for achieving desired outcomes.

Tips for Maximizing the Benefits of Dollar-Cost Averaging

- Stick to the Plan: Consistency is key. Regular investments are crucial for DCA to work effectively.

- Choose Low-Cost Investments: Minimize fees to enhance overall returns.

- Review and Adjust: Regularly review your investment strategy and make adjustments as needed based on performance and financial goals.

Must Read: How to Use Margin Trading to Amplify Your Gains?

Frequently Asked Questions

How often should I invest with Dollar-Cost Averaging?

The frequency of investment can vary based on individual preferences and financial situations. Monthly investments are common, but you can choose a different interval.

Can Dollar-Cost Averaging be used for retirement accounts?

Yes, DCA is commonly used for retirement accounts like 401(k)s and IRAs to build wealth over time.

What happens if I miss an investment period?

Missing an investment period can affect the average cost per share but won’t necessarily negate the benefits of DCA if you continue investing regularly.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!