Introduction

Investing has undergone a significant transformation over the past decade, thanks to technological advancements. One of the most notable innovations in this space is the advent of robo-advisors. These digital platforms are revolutionizing the way people invest by offering automated, algorithm-driven financial planning services. But what exactly are robo-advisors, and how do they fit into the modern investing landscape?

What is a Robo-Advisor?

A robo-advisor is an online financial advisor that provides automated, algorithm-driven financial planning services with little to no human supervision. Robo-advisors collect information from clients about their financial situation and future goals through an online survey, and then use the data to offer advice and/or automatically invest client assets.

History of Robo-Advisors

The concept of robo-advisors emerged in the wake of the 2008 financial crisis, as investors sought more cost-effective and transparent investment options. The first robo-advisors began as simple algorithmic trading platforms, but have since evolved to offer a wide range of financial planning services.

How Robo-Advisors Work?

Algorithms and Automation

At the core of any robo-advisor is its algorithm. These algorithms are designed to create and manage a diversified portfolio based on the user’s risk tolerance, investment goals, and time horizon. They automatically rebalance portfolios and can perform tax-loss harvesting to optimize returns.

User Experience and Interface

One of the key selling points of robo-advisors is their user-friendly interface. Most platforms offer a seamless online experience, with intuitive dashboards that allow users to monitor their investments, set goals, and make adjustments as needed. This ease of use is a major factor in their growing popularity.

Benefits of Using Robo-Advisors

Cost-Effectiveness

Traditional financial advisors can be expensive, often charging 1% to 2% of the assets under management. Robo-advisors, on the other hand, typically charge a fraction of this cost, making professional financial advice accessible to a broader audience.

Accessibility and Convenience

Robo-advisors are available 24/7, allowing users to manage their investments at their convenience. This level of accessibility is particularly appealing to younger investors who are comfortable with technology and prefer to manage their finances online.

Also Read: Dividend Investing: How to Create a Steady Income Stream in 2024?

Types of Robo-Advisors

Fully Automated Advisors

Fully automated robo-advisors handle all aspects of portfolio management, from initial investment selection to ongoing rebalancing. These platforms are ideal for investors who prefer a hands-off approach and trust the algorithm to make investment decisions.

Hybrid Robo-Advisors

Hybrid robo-advisors combine automated portfolio management with access to human financial advisors. This model offers the best of both worlds: the efficiency and cost-effectiveness of automation, along with the personalized advice of a human advisor.

Robo-Advisors vs. Traditional Advisors

Cost Comparison

One of the primary advantages of robo-advisors is their lower cost. Traditional advisors often charge higher fees due to the personalized service they provide. Robo-advisors, by leveraging technology, can offer similar services at a much lower price point.

Performance Comparison

Performance can vary widely between robo-advisors and traditional advisors. While some studies suggest that robo-advisors perform as well as or better than their human counterparts, it’s important to note that performance is heavily dependent on the algorithms and investment strategies used.

Key Features of Robo-Advisors

Portfolio Management

Robo-advisors typically use Modern Portfolio Theory (MPT) to create diversified portfolios that aim to maximize returns for a given level of risk. They automatically rebalance portfolios to maintain the desired asset allocation.

Tax-Loss Harvesting

Many robo-advisors offer tax-loss harvesting, a strategy that involves selling securities at a loss to offset gains in other investments. This can help reduce an investor’s tax liability and improve after-tax returns.

Popular Robo-Advisors in the Market

Betterment

Betterment is one of the pioneers in the robo-advisory space. It offers a wide range of services, including automated portfolio management, tax-loss harvesting, and access to human advisors.

Wealthfront

Wealthfront is another major player, known for its sophisticated algorithms and user-friendly platform. In addition to standard robo-advisory services, Wealthfront offers financial planning tools and lending services.

Must Read: Investing in Startups: High Risk, High Reward?

How to Choose the Right Robo-Advisor?

Assessing Your Investment Goals

Before choosing a robo-advisor, it’s important to understand your investment goals. Are you saving for retirement, a down payment on a house, or something else? Different robo-advisors may be better suited to different goals.

Evaluating Fees and Services

Fees can vary widely among robo-advisors. Be sure to compare the costs and services offered by different platforms to find the one that best meets your needs.

The Future of Robo-Advisors

Technological Advancements

As technology continues to evolve, so too will robo-advisors. Advances in artificial intelligence and machine learning are expected to make these platforms even more sophisticated and personalized.

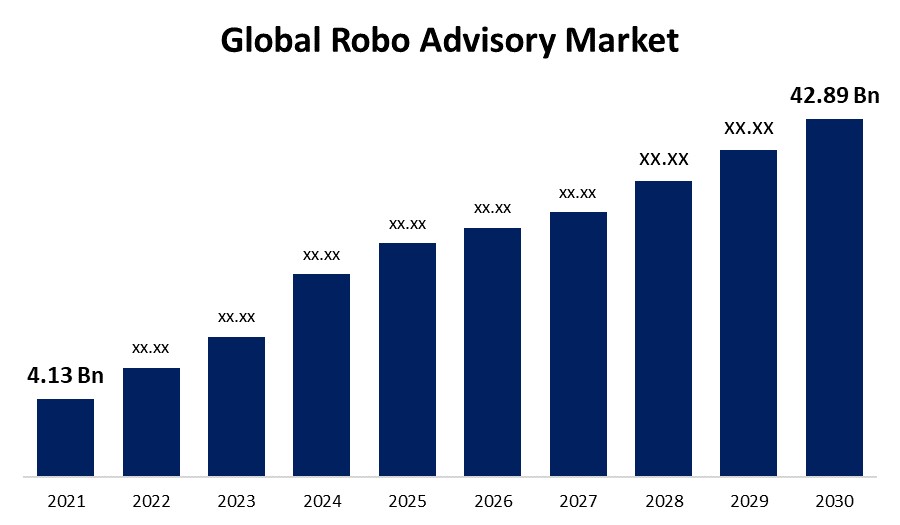

Market Trends

The popularity of robo-advisors is likely to continue growing, particularly among younger investors. As more people become comfortable with technology, the demand for digital financial services will increase.

Case Studies of Successful Robo-Advisors

Betterment Case Study

Betterment has successfully attracted a large user base by offering a seamless, user-friendly experience and a wide range of services. Its ability to provide personalized advice at a low cost has been a key factor in its success.

Wealthfront Case Study

Wealthfront’s focus on technology and innovation has set it apart from competitors. Its sophisticated algorithms and comprehensive financial planning tools have made it a favorite among tech-savvy investors.

Common Misconceptions about Robo-Advisors

Lack of Personalization

One common misconception is that robo-advisors cannot provide personalized advice. While it’s true that they rely on algorithms, many platforms offer customizable portfolios and access to human advisors for more personalized guidance.

Risk Management Concerns

Some investors worry that robo-advisors may not manage risk effectively. However, most robo-advisors use advanced risk management techniques and regularly rebalance portfolios to ensure they remain aligned with the investor’s risk tolerance.

The Impact of Robo-Advisors on the Financial Industry

Disruption of Traditional Advisory Services

Robo-advisors have disrupted the financial industry by offering a low-cost alternative to traditional advisory services. This has forced traditional advisors to reconsider their fee structures and service offerings to remain competitive.

Increased Market Participation

By lowering the barriers to entry, robo-advisors have made investing more accessible to a wider audience. This has led to increased market participation, particularly among younger investors who may not have invested otherwise.

Regulatory Considerations for Robo-Advisors

Compliance Requirements

Robo-advisors must comply with the same regulatory requirements as traditional financial advisors. This includes registering with the Securities and Exchange Commission (SEC) and adhering to fiduciary standards.

Consumer Protection

Regulators are increasingly focused on ensuring that robo-advisors provide transparent and fair services to consumers. This includes monitoring their algorithms and ensuring they act in the best interests of their clients.

Ethical Considerations in Robo-Advising

Transparency in Algorithms

One of the key ethical considerations for robo-advisors is the transparency of their algorithms. Investors should understand how their money is being managed and the risks involved.

Data Privacy

Robo-advisors collect a significant amount of personal data from their users. Ensuring the privacy and security of this data is crucial to maintaining trust and protecting investors.

Also Read: Gold and Precious Metals: Are They Worth Investing In? (2024)

Conclusion

Robo-advisors are playing an increasingly important role in modern investing. By offering cost-effective, accessible, and efficient financial planning services, they have democratized investing and made it more accessible to a wider audience. While they are not without their challenges and limitations, the future of robo-advisors looks bright as technology continues to advance and more people embrace digital financial services.

FAQs

What is a Robo-Advisor and how does it work?

A robo-advisor is an online platform that provides automated financial planning services. It collects information from users about their financial situation and goals, and uses algorithms to create and manage a diversified investment portfolio.

Are Robo-Advisors safe to use?

Yes, robo-advisors are generally safe to use. They must comply with regulatory requirements and adhere to fiduciary standards, ensuring they act in the best interests of their clients. However, it’s important to choose a reputable platform and understand the associated risks.

Can Robo-Advisors replace human financial advisors?

While robo-advisors offer many advantages, they may not completely replace human advisors, especially for investors with complex financial needs. Hybrid models that combine automated services with access to human advisors offer a balanced approach.

How much do Robo-Advisors typically cost?

Robo-advisors typically charge lower fees than traditional advisors, often ranging from 0.25% to 0.50% of assets under management. Some platforms may also charge additional fees for specific services.

What kind of returns can I expect from using a Robo-Advisor?

Returns vary depending on the platform, the algorithms used, and market conditions. While some robo-advisors have shown strong performance, it’s important to remember that all investments carry risks and past performance is not indicative of future results.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Investing involves risk, including the possible loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or gains resulting from the use of this information.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!