Investing in dividend stocks can be an excellent way to build wealth and secure financial stability. In this article, we’ll explore the top 10 dividend stocks that you can consider adding to your investment portfolio right now.

Understanding Dividend Stocks

Dividend stocks are shares of companies that distribute a portion of their earnings to shareholders in the form of dividends. These dividends are typically paid out regularly, providing investors with a steady stream of passive income.

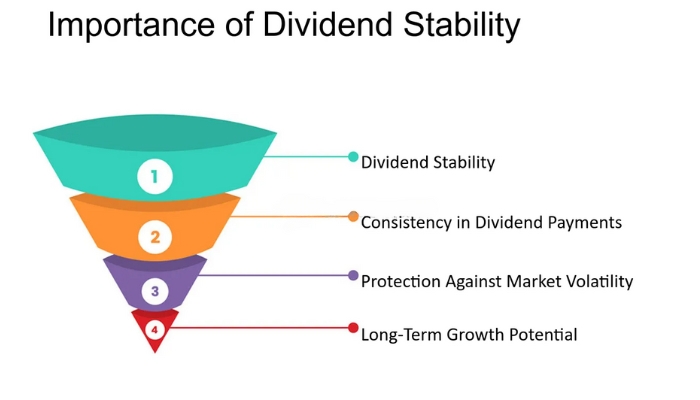

Importance of Dividend Stocks

Stability

Dividend stocks are often associated with stable, well-established companies that have a proven track record of generating profits. Investing in these companies can help mitigate risk and provide stability to your investment portfolio.

Passive Income

One of the most significant advantages of dividend stocks is the passive income they generate. By investing in dividend-paying companies, you can earn regular cash payments without having to sell your shares.

Long-Term Growth

In addition to providing passive income, dividend stocks can also offer long-term growth potential. Reinvesting dividends can accelerate the growth of your investment portfolio over time, leading to greater wealth accumulation.

Criteria for Selecting Dividend Stocks

When choosing dividend stocks to invest in, it’s essential to consider several key factors:

Dividend Yield

The dividend yield is a measure of the annual dividend income relative to the stock price. A higher dividend yield indicates a higher return on investment.

Dividend Growth Rate

Companies that consistently increase their dividends over time demonstrate financial strength and a commitment to shareholder value. Look for companies with a history of steady dividend growth.

Payout Ratio

The payout ratio measures the percentage of earnings that a company pays out in dividends. A lower payout ratio suggests that a company has more room to increase its dividends in the future.

Company Stability

Investing in stable, financially sound companies is crucial for long-term success. Conduct thorough research into the company’s financial health, business model, and competitive advantages.

Top 10 Best Dividend Stocks

1. Verizon Communications (VZ)

- A leading telecommunications company in the US, providing wireless and internet services.

2. PNC Financial Services (PNC)

- A large regional bank in the US offers banking and financial services to individuals and businesses.

3. Chevron Corporation (CVX)

- A major integrated oil and gas company involved in exploration, production, refining, and marketing of oil and gas products.

4. Exxon Mobil Corporation (XOM)

- Another major integrated oil and gas company, similar to Chevron.

5. AbbVie Inc. (ABBV)

- A research-based biopharmaceutical company that develops and markets drugs for various therapeutic areas.

6. PepsiCo Inc. (PEP)

- A leading beverage and snack food company with a large portfolio of popular brands.

7. Coca-Cola Company (KO)

- Another beverage giant, well known for its namesake soft drink and other brands.

8. Johnson & Johnson (JNJ)

- A multinational pharmaceutical, medical device, and consumer health products company.

Walgreen Boots Alliance, Inc. (WBA)

- A leading pharmacy chain in the US and internationally.

10. Merck & Co., Inc. (MRK)

- A global pharmaceutical company with a focus on prescription drugs, vaccines, and animal health products.

Remember: This is a starting point for your research. You should always consult with a financial advisor before making any investment decisions. pen_spark tune share more_vert

Conclusion

Investing in dividend stocks can be an excellent strategy for building wealth and generating passive income. By carefully selecting high-quality companies with a history of stable dividends, you can create a diversified investment portfolio that provides both income and growth potential.

Must Read:

- Grange Resources Limited (GRR) Dividend Breakdown: Dates and Trends You Need to Know

- 5 Expert Tips to Master Stock Market Volatility

- How to Predict Stock Market Trends Like a Pro in India (2024)

- 10 Surprising Stock Market Tips Every Investor Needs to Know!

FAQs

How often are dividends paid out?

Dividend payment frequencies vary by company but are typically paid out quarterly or annually.

What is a dividend-reinvestment plan (DRIP)?

A DRIP allows shareholders to automatically reinvest their dividends into additional shares of the company’s stock.

Are dividend stocks suitable for all investors?

While dividend stocks can be an attractive investment option, they may not be suitable for all investors, particularly those seeking high-growth opportunities.

What happens if a company cuts its dividend?

If a company cuts its dividend, it may signal financial distress or a change in business strategy, which could negatively impact the stock price.

How can I evaluate a company’s dividend sustainability?

To assess a company’s dividend sustainability, consider factors such as its earnings growth, cash flow, and payout ratio. Additionally, analyzing industry trends and competitive dynamics can provide valuable insights into future dividend prospects.

Disclaimer: The information provided in this article is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any specific securities mentioned. Investing in the stock market involves risk, including the potential loss of principal. Before making any investment decisions, individuals should conduct their own research and consult with a qualified financial advisor. The author and publisher of this article are not responsible for any losses or damages resulting from any investment decisions made based on the information provided herein.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!