Identify Stock Market Bubbles: Stock market bubbles are fascinating yet dangerous phenomena. A bubble occurs when the price of an asset, such as stocks, rises significantly over its intrinsic value, driven by exuberant market behavior. Understanding these bubbles is essential to avoid financial disaster. But how do you identify a bubble before it bursts? Let’s dive in.

Historical Context of Stock Market Bubbles

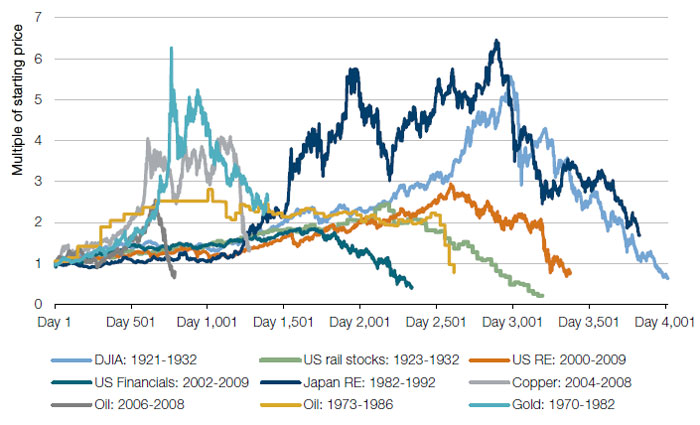

To identify a stock market bubble, it is crucial to understand their historical context. One of the earliest recorded bubbles was the Dutch Tulip Mania of the 1630s. Tulip bulbs reached extraordinarily high prices before crashing, causing financial ruin for many. The South Sea Bubble of 1720 in Britain is another classic example, where speculation in the South Sea Company’s stock led to a dramatic rise and fall.

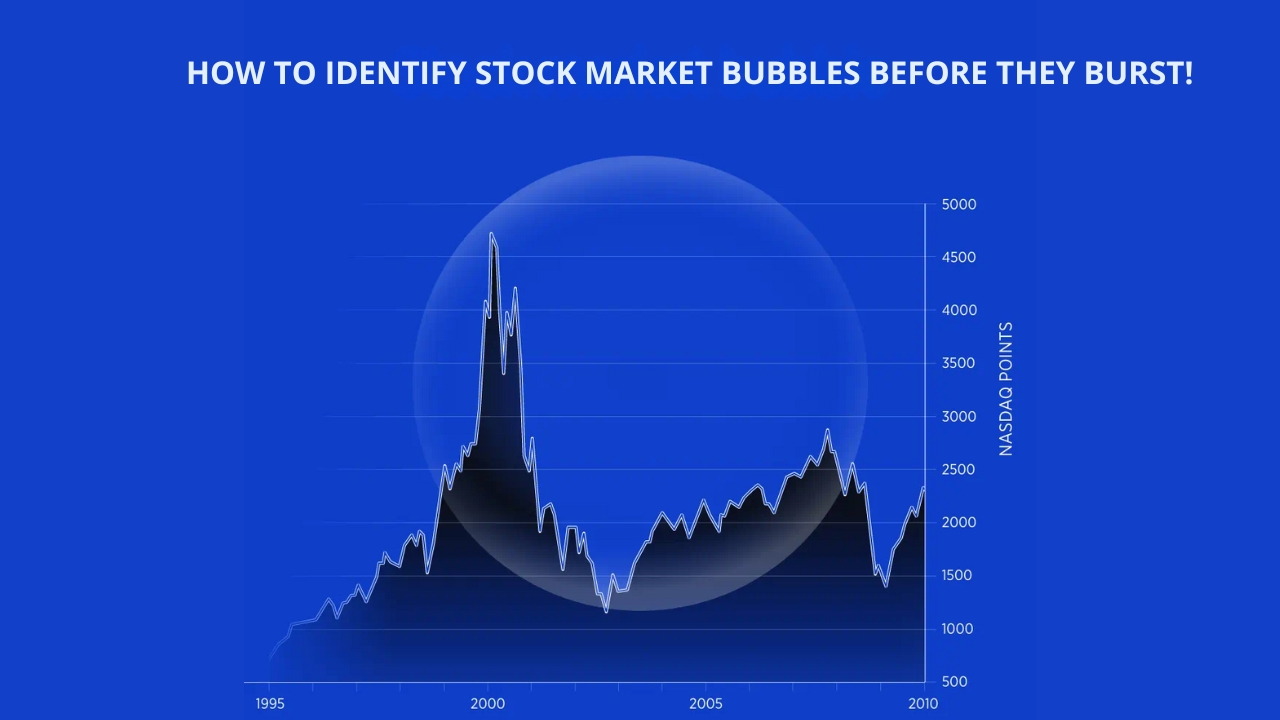

A more recent example is the Dot-com Bubble of the late 1990s. Investors poured money into internet-based companies, many of which had little to no revenue. The NASDAQ Composite index peaked in March 2000, then fell sharply, wiping out trillions in market value. Similarly, the 2008 financial crisis was preceded by a housing bubble, where excessive speculation and subprime lending led to an unsustainable rise in housing prices.

These historical instances share common traits, including rapid price increases, speculative investor behavior, and eventual sharp declines. By studying past bubbles, investors can better recognize potential warning signs in the present market.

Characteristics of Stock Market Bubbles

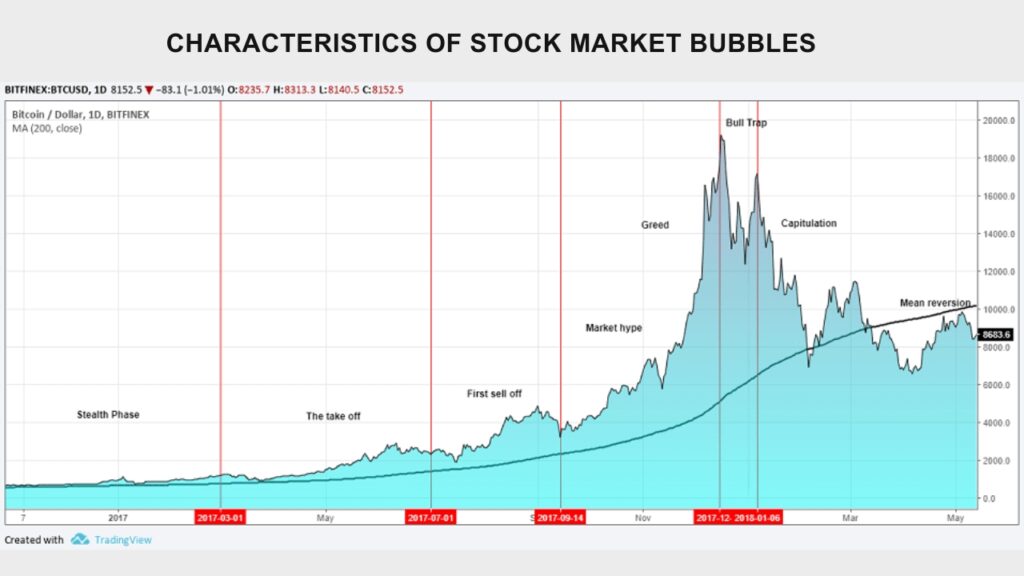

Identifying a bubble requires recognizing its key characteristics. One prominent feature is the rapid and unsustainable increase in asset prices. When prices rise significantly faster than historical averages without corresponding improvements in underlying fundamentals, a bubble may be forming.

Another characteristic is high trading volumes. During a bubble, trading activity increases as more investors try to capitalize on rising prices. This frenzy often leads to further price inflation. Additionally, bubbles are marked by widespread speculative behavior, where investors buy assets not based on intrinsic value but on the expectation of selling them at higher prices.

Moreover, bubbles often exhibit a disconnect between asset prices and fundamentals. For example, during the Dot-com Bubble, companies with little to no earnings were valued at billions of dollars. This disconnect is a red flag for investors.

A crucial aspect of bubbles is the “greater fool” theory, where investors buy overvalued assets hoping to sell them to someone else at a higher price. This speculative mentality perpetuates the bubble until it eventually bursts, leaving the last investors—often the “greater fools”—with significant losses.

Also Read: How to Invest in the Stock Market Without Losing Sleep!

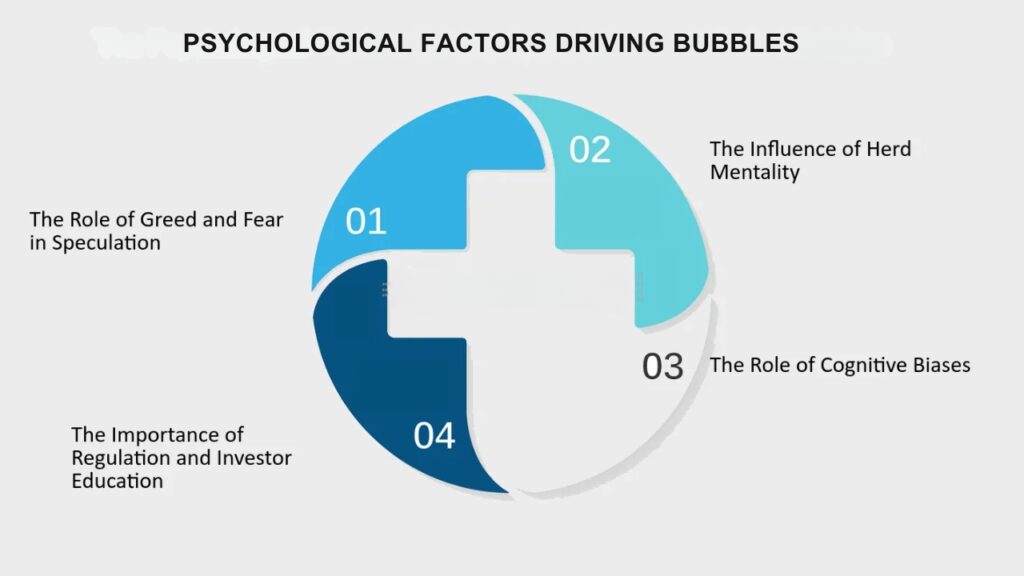

Psychological Factors Driving Bubbles

Human psychology plays a significant role in the formation and burst of stock market bubbles. Behavioral finance identifies several cognitive biases that contribute to this phenomenon. Herd behavior is one such bias, where individuals follow the actions of a larger group, believing the group must be right. This can lead to irrational buying and selling.

Confirmation bias is another psychological factor. Investors tend to seek out information that confirms their existing beliefs and ignore contradictory evidence. During a bubble, investors may only pay attention to positive news, reinforcing their belief in ever-rising prices.

Overconfidence is also prevalent in bubble periods. Investors often overestimate their knowledge and predictive abilities, leading them to take excessive risks. This overconfidence can drive asset prices higher as more investors pile into the market.

The fear of missing out (FOMO) is a powerful psychological driver. As prices rise, more investors fear being left out of potential gains and rush to buy assets, further inflating the bubble. This creates a feedback loop where rising prices attract more buyers, pushing prices even higher.

Economic Indicators of a Bubble

Several economic indicators can signal the presence of a stock market bubble. One important indicator is the price-to-earnings (P/E) ratio. During bubbles, P/E ratios often soar to unsustainable levels. For example, before the Dot-com Bubble burst, many tech companies had P/E ratios exceeding 100, far above historical norms.

Another indicator is the price-to-book (P/B) ratio, which compares a company’s market value to its book value. A high P/B ratio can indicate overvaluation, especially when it deviates significantly from historical averages.

The yield curve is also a valuable tool for identifying bubbles. An inverted yield curve, where short-term interest rates are higher than long-term rates, often precedes economic recessions and market corrections. It suggests that investors expect lower future growth, which can indicate an overheated market.

Additionally, the debt levels of corporations and households can provide clues. High levels of leverage can amplify market movements and increase vulnerability to shocks. During the 2008 financial crisis, excessive borrowing in the housing market contributed to the severity of the bubble burst.

Also Read: How to Turn Your Stock Market Hobby into a Full-Time Income!

Market Sentiment Analysis

Analyzing market sentiment can provide insights into the potential formation of a bubble. Sentiment indicators measure the overall mood of investors, which can be overly optimistic during bubble periods. One common sentiment indicator is the investor sentiment index, which surveys the outlook of market participants.

Social media and news trends can also offer valuable sentiment data. During the 2021 GameStop frenzy, social media platforms like Reddit played a significant role in driving stock prices. By monitoring online discussions and sentiment, investors can gauge the level of speculative interest in the market.

Another tool is the VIX index, also known as the “fear gauge.” The VIX measures market volatility and can indicate investor anxiety. Low VIX levels often correlate with complacency and overconfidence, which are common during bubbles.

Technological Impact on Bubbles

Technology has a profound impact on the formation and burst of stock market bubbles. Advances in technology can create new investment opportunities, attracting speculative capital. The Dot-com Bubble is a prime example, where the advent of the internet led to a surge in tech stock investments.

Technological innovations can also amplify market movements. High-frequency trading (HFT), for instance, uses algorithms to execute trades at lightning speed. While HFT can increase liquidity, it can also exacerbate market volatility during bubble periods.

Furthermore, social media platforms can rapidly spread information and influence investor behavior. The GameStop saga demonstrated how online communities could drive stock prices to extreme levels, fueled by collective buying.

Cryptocurrencies represent another area where technology impacts bubbles. The 2017 Bitcoin bubble saw prices skyrocket as investors flocked to digital assets. While blockchain technology has legitimate applications, the speculative nature of cryptocurrencies can lead to rapid price increases and sharp corrections.

Warning Signs of a Bubble

Recognizing warning signs is crucial for identifying stock market bubbles. One red flag is excessive valuation metrics, such as extremely high P/E ratios or P/B ratios. When these metrics deviate significantly from historical norms, it suggests overvaluation.

Another warning sign is parabolic price movements. When asset prices rise rapidly and form steep upward curves, it indicates unsustainable growth. This pattern was evident in the housing market before the 2008 financial crisis.

Excessive leverage is also a warning sign. High levels of borrowing can magnify market movements and increase vulnerability to shocks. During the 2008 crisis, the housing market’s reliance on subprime mortgages and leveraged investments contributed to the bubble’s burst.

A surge in initial public offerings (IPOs) can signal a bubble. When companies rush to go public to capitalize on high valuations, it indicates speculative behavior. The Dot-com Bubble saw a flurry of IPOs from tech startups, many of which failed after the bubble burst.

Case Studies of Famous Bubbles

Examining case studies of famous bubbles provides valuable lessons. The Dot-com Bubble of the late 1990s saw tech stocks soar to unprecedented heights before crashing. Investors poured money into internet-based companies, driven by the promise of revolutionary technology. However, many of these companies had no viable business models, leading to massive losses when the bubble burst.

The 2008 financial crisis was preceded by a housing bubble, where excessive speculation and subprime lending led to skyrocketing home prices. When the bubble burst, it triggered a global financial meltdown, highlighting the dangers of leveraged investments and speculative behavior.

Another notable example is the 2021 GameStop frenzy. Driven by retail investors on social media platforms, GameStop’s stock price surged dramatically. The bubble showcased the power of collective buying and the influence of technology on market behavior. However, the rapid rise was followed by a sharp decline, underscoring the risks of speculative trading.

Also Read: How to Use AI and Machine Learning in Stock Market Trading!

Protecting Investments During a Bubble

Protecting investments during a bubble requires a cautious and disciplined approach. Diversification is a key strategy. By spreading investments across different asset classes and sectors, investors can reduce their exposure to a single bubble. Diversification helps mitigate the impact of a bubble burst on the overall portfolio.

Another strategy is to maintain a long-term perspective. Short-term market fluctuations are common during bubbles, and reacting impulsively can lead to poor investment decisions. Staying focused on long-term goals and fundamentals can help investors navigate turbulent markets.

It’s also important to regularly review and rebalance the portfolio. As asset prices rise during a bubble, some investments may become overvalued. Rebalancing involves selling overvalued assets and reinvesting in undervalued ones, maintaining a balanced portfolio.

Lastly, keeping an emergency fund and avoiding excessive leverage are prudent measures. During a bubble burst, liquidity is crucial to cover unexpected expenses or take advantage of investment opportunities. Avoiding high levels of debt reduces the risk of financial strain when markets correct.

FAQs

What is a stock market bubble?

A stock market bubble occurs when the price of an asset, such as stocks, rises significantly over its intrinsic value, driven by exuberant market behavior. Bubbles are characterized by rapid price increases, speculative investor behavior, and eventual sharp declines.

How can I identify a stock market bubble?

Identifying a bubble involves recognizing key characteristics such as rapid and unsustainable price increases, high trading volumes, widespread speculative behavior, and a disconnect between asset prices and fundamentals. Economic indicators, market sentiment analysis, and historical context also provide valuable clues.

What are the psychological factors driving stock market bubbles?

Human psychology plays a significant role in bubbles. Cognitive biases such as herd behavior, confirmation bias, overconfidence, and fear of missing out (FOMO) contribute to irrational buying and selling, driving asset prices higher and perpetuating the bubble.

What economic indicators signal a stock market bubble?

Economic indicators such as high price-to-earnings (P/E) ratios, high price-to-book (P/B) ratios, an inverted yield curve, and excessive debt levels can signal the presence of a bubble. These indicators suggest overvaluation and increased vulnerability to market corrections.

How does technology impact stock market bubbles?

Technology creates new investment opportunities and can amplify market movements. Advances in technology, high-frequency trading, social media influence, and cryptocurrencies all impact bubbles by attracting speculative capital and influencing investor behavior.

What are some warning signs of a stock market bubble?

Warning signs include excessive valuation metrics, parabolic price movements, excessive leverage, and a surge in initial public offerings (IPOs). These red flags indicate overvaluation and speculative behavior.

Can you provide examples of famous stock market bubbles?

Notable examples include the Dutch Tulip Mania, the South Sea Bubble, the Dot-com Bubble, the 2008 housing bubble, and the 2021 GameStop frenzy. These case studies highlight the dangers of speculative behavior and the eventual sharp declines following bubble bursts.

How can I protect my investments during a bubble?

Protecting investments during a bubble involves diversification, maintaining a long-term perspective, regularly reviewing and rebalancing the portfolio, keeping an emergency fund, and avoiding excessive leverage. These strategies help mitigate the impact of a bubble burst on the overall portfolio.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered financial or investment advice. Investing in the stock market involves risks, and you should conduct your own research and consult with a professional financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or damages that may occur as a result of following the information provided in this article.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!