Introduction

Are you eager to dive into the world of stock market predictions but don’t know where to start? You’re not alone! Understanding how to interpret these predictions can be the key to making savvy investment decisions. In this guide, we’ll break down the essentials of stock market forecasts and teach you how to interpret them like a pro. Let’s get started!

Understanding Stock Market Predictions

So, what exactly are stock market predictions? In simple terms, these are forecasts made by financial experts about the future performance of stocks, sectors, or entire markets. These predictions are crafted using a combination of historical data, current market trends, and economic indicators. The key players in stock market forecasting include analysts, financial institutions, and investment firms.

Types of Stock Market Predictions

Stock market predictions can vary widely based on their time frame and methodology:

- Short-term vs Long-term Predictions: Short-term predictions focus on immediate market movements, often within days or weeks. Long-term predictions look at broader trends over months or years.

- Fundamental Analysis-based Predictions: These are grounded in the financial health and performance of companies, examining factors like earnings, revenue, and industry position.

- Technical Analysis-based Predictions: These rely on historical price movements and trading volumes, using charts and technical indicators to predict future price behavior.

Key Indicators in Stock Market Predictions

Several indicators play a crucial role in shaping stock market predictions:

- Economic Indicators: GDP growth, unemployment rates, and inflation are just a few examples that can signal the health of the economy and influence market predictions.

- Market Sentiment Indicators: These gauge investor mood and outlook, often through surveys or sentiment indexes.

- Technical Indicators: Tools like moving averages, the Relative Strength Index (RSI), and Bollinger Bands help analysts predict market movements based on past price data.

Also Read: 10 Hidden Stock Market Secrets That Will Make You Rich!

Fundamental Analysis

Fundamental analysis is all about digging into the financial health of a company. Key metrics to consider include:

- P/E Ratio (Price-to-Earnings Ratio): Indicates how much investors are willing to pay per dollar of earnings.

- EPS (Earnings Per Share): A measure of a company’s profitability.

- Debt-to-Equity Ratio: Assesses a company’s financial leverage.

Using fundamental analysis, you can evaluate whether a stock is undervalued or overvalued, helping you make informed investment decisions.

Technical Analysis

Technical analysis, on the other hand, focuses on historical market data. Important tools and concepts include the following:

- Charts: Visual representations of price movements over time.

- Moving Averages: These smooth out price data to identify trends.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

By mastering technical analysis, you can spot patterns and trends that might indicate future price movements.

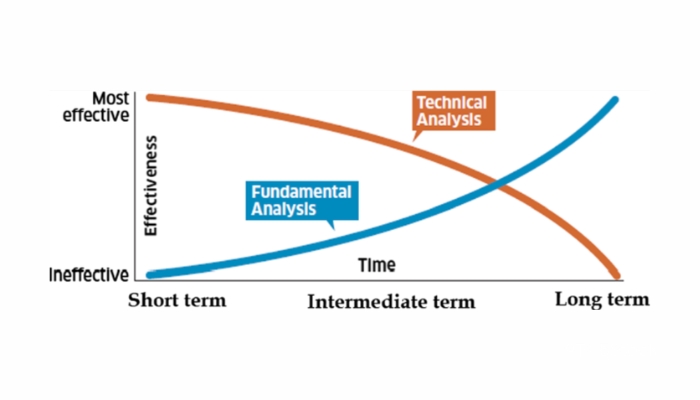

Combining Fundamental and Technical Analysis

Why choose one when you can have the best of both worlds? Combining fundamental and technical analysis provides a more comprehensive view of the market. For example, you might use fundamental analysis to identify strong companies and technical analysis to pinpoint the best entry and exit points.

Reading Stock Market Forecast Reports

Stock market reports can be a goldmine of information—if you know how to read them. Start by familiarizing yourself with common terminologies like “bullish,” “bearish,” and “volatility.” Next, look for reliable sources such as major financial news outlets and reputable investment firms. Finally, learn to interpret different types of reports, from analyst ratings to economic forecasts.

Evaluating Prediction Accuracy

Not all predictions are created equal. To assess the accuracy of a forecast, consider the analyst’s historical performance and track record. Look for consistency and reliability, and always compare multiple opinions before making decisions.

Common Pitfalls in Interpreting Predictions

Even the best predictions can go awry if you’re not careful. Avoid these common pitfalls:

- Over-reliance on Single Sources: Diversify your information sources to get a balanced view.

- Ignoring Market Conditions: Always consider the broader economic and market context.

- Emotional Decision-making: Keep your emotions in check and base your decisions on data and analysis.

Also Read: The Best Stock Market Strategies to Maximize Your Returns (2024)

Tools and Resources for Stock Market Predictions

Equip yourself with the best tools and resources to enhance your stock market prediction skills. Some of the top recommendations include:

- Websites and Apps: Yahoo Finance, Bloomberg, and Investing.com are great places to start.

- Financial News Outlets: Stay updated with the latest market news from sources like CNBC and Reuters.

- Stock Analysis Software: Tools like TradingView and MetaStock offer powerful features for technical analysis.

Developing Your Own Forecasting Skills

Want to become a pro at forecasting? Here’s how:

- Continuous Learning and Education: Take courses, read books, and follow market experts to keep improving your skills.

- Practicing with Mock Investments: Use virtual trading platforms to test your predictions without risking real money.

- Joining Investment Communities: Engage with other investors to exchange insights and strategies.

The Role of News and Events

Global news and events can have a significant impact on stock markets. Key factors to watch include:

- Global News: Political developments, natural disasters, and geopolitical tensions can influence market movements.

- Earnings Reports: Quarterly earnings reports provide insights into a company’s performance and future prospects.

- Economic Policy Changes: Changes in interest rates, tax policies, and regulations can affect market predictions.

Must Read: How to Build a Strong Stock Portfolio in 2024

Adapting to Market Changes

The stock market is always evolving, and so should your predictions. Stay flexible by regularly reviewing and adjusting your forecasts. Learn from your mistakes and use them as opportunities to refine your approach.

Conclusion

Interpreting stock market predictions might seem daunting at first, but with the right knowledge and tools, anyone can do it. By understanding the basics of fundamental and technical analysis, reading forecast reports, and staying adaptable, you’ll be well on your way to making informed investment decisions. So, start interpreting predictions like a pro today!

FAQs

What are the most reliable sources for stock market predictions?

Reliable sources include major financial news outlets like Bloomberg, CNBC, and Reuters, as well as reputable investment firms and analysts with a strong track record.

How often should I review my stock market predictions?

It’s a good idea to review your predictions regularly, at least on a quarterly basis, and adjust them as needed based on new information and market changes.

Can beginners effectively interpret stock market predictions?

Yes, beginners can effectively interpret stock market predictions by starting with the basics, continuously learning, and using available tools and resources.

How do global events impact stock market predictions?

Global events such as political developments, economic policies, and natural disasters can significantly impact stock market predictions by influencing investor sentiment and market conditions.

Is it possible to predict the stock market with 100% accuracy?

No, it is not possible to predict the stock market with 100% accuracy due to its inherent volatility and the influence of unpredictable external factors. However, informed predictions can still guide better investment decisions.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial or investment advice. Always consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or damages incurred from the use of this information. Investments in the stock market involve risk, and it is important to conduct thorough research and consider your financial situation before investing.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!